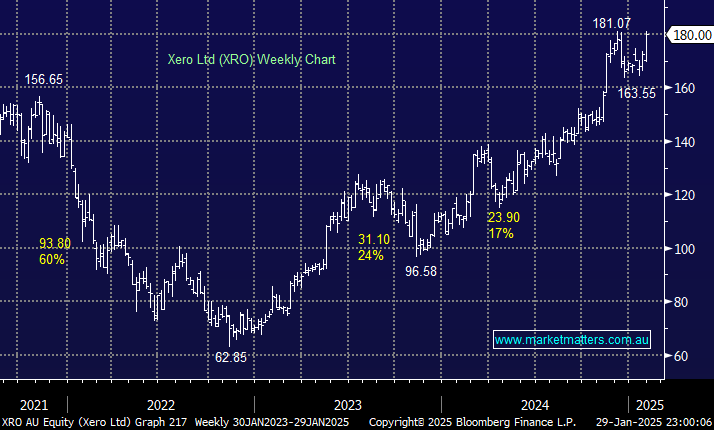

Our XRO position is up over 75%, and like the ASX200, it’s knocking on the door of all-time highs. The online accounting business delivered another solid result in November, showcasing how it is successfully balancing growth with improving earnings. Especially important after yesterday’s CPI, XRO’s expansion into the US & UK looks well-timed, with ~40% of revenue coming from overseas in FY24. In the US, it has rolled out enhanced payment solutions in partnership with Stripe, which MM uses, enabling features like Tap to Pay and “Buy Now, Pay Later” options within its ecosystem.

The stock is expensive and on traditional valuation metrics it’s scary, however, the metric that matters for XRO is growth, but more importantly, sustainable growth in earnings with good margins. Much like Netflix, XRO is now firmly monetising its captive audience by increasing prices on existing plans, while still bringing on new subscribers, and that is having a material impact on earnings; we believe net profit will grow at an average growth rate of ~40% for the next 3 years.

That’s not to say the stock will move in a straight line, it is very capable of ~20% pullbacks as history has shown, though, as earnings continue to grow, share prices follow earnings over time, and we’re happy to stick with this position.

- We can see XRO testing $190-$200 over the coming months – MM is long XRO in its Active Growth Portfolio.