- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

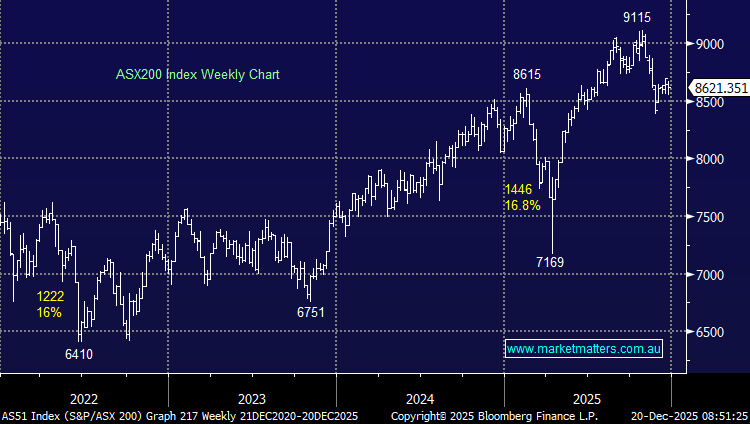

The ASX pushed higher on Friday, supported by a rebound in technology stocks and strength across the banks, following softer-than-expected US inflation data that reignited expectations for further Federal Reserve rate cuts. Despite today’s gains, the market is still tracking its first weekly decline in four weeks.

- The ASX200 fell-13pts/-0.16% to close at 8585, rallying ~35pts from the 11.30am low.

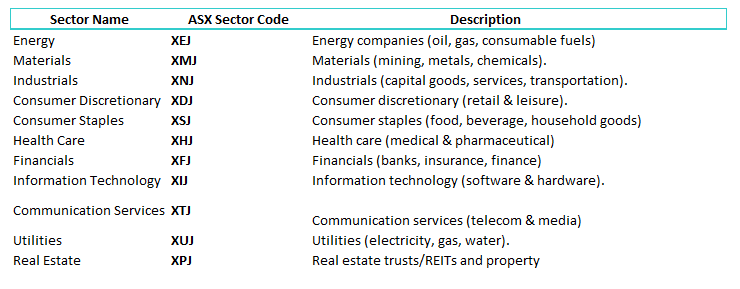

- Technology (+2.22%), Financials (+1.07%) and Industrials (+0.88%) led the line.

- Staples (-0.57%), Materials (-0.57%) and Communications (-0.26%) dragged.

- Technology rebounded, with Xero (XRO) rose +2.3%, while WiseTech (WTC) +3.1% gained after a board review into co-founder and executive chairman Richard White found no further issues to investigate.

- Megaport Limited (MP1) +3.8%, Novonix Limited (NVX) +3.7% and EML Payments Limited (EML) +3.1% were also stronger, each up around +XX%.

- Banks were also on the up, Commonwealth Bank (CBA) +1.8% outperformed, with Westpac (WBC) +1.3%, National Bank (NAB) +0.8% and ANZ flat.

- Macquarie (MQG) rose +1.5% despite its securities arm being fined $35 million by ASIC over historic short-sale reporting issues.

- Uranium’s had a good session; Boss Energy (BOE) +11.4%, while Paladin (PDN) surged +9.2% and Deep Yellow (DYL)+8.7% rallied following heavy selling in the prior session.

- Fortescue (FMG) fell -3.2% to be among the worst performers, with BHP Group (BHP) -1.1% also lower as iron ore prices eased.

- 4DMedical Limited (4DX) +21.4% surged after securing a commercial agreement with renowned Cleveland Clinic to deploy its CT:VQ respiratory imaging technology.

- Netwealth (NWL) -6.5% fell after agreeing to pay $101 million to compensate superannuation customers who invested in First Guardian, removing a key regulatory and reputational overhang.

- Austal (ASB) +5.7% after securing a contract extension valued at more than $135 million to build two additional Evolved Cape-class patrol boats for the Australian Border Force.

- Qube Holdings (QUB) +0.8% edged higher as the company and Macquarie Asset Management allowed their exclusivity period and associated deed to continue.

- Aussie Broadband (ABB) fell –1.4% after warning the ACCC’s new regulated voice interconnection rates would reduce earnings from its wholesale networks from FY27.

- US core consumer price inflation rose less than expected overnight, though the data may have been distorted by the recent government shutdown.

- Markets are pricing around a 25% chance of a January rate cut by the Federal Reserve and close to certainty by April.

- In Japan, the Bank of Japan raised rates to 0.75% as expected; the yen softened modestly while 10-year government bond yields hit their highest level since 2006.

- Gold was down $US12/oz at US$4320/oz.

- Iron ore was lower trading $US104.05/mt

- Asian markets were higher, with China up +0.60%, Hong Kong +0.65% and Japan up +0.8%

- US futures are fairly flat.