- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A very quiet session for Aussie stocks today, though the recent trend continued with buying of weakness, although the dip was only small this morning. Xero (XRO) came back online post cap raise, down ~9% early but saw strong buying during the session to recover 50% of its loses.

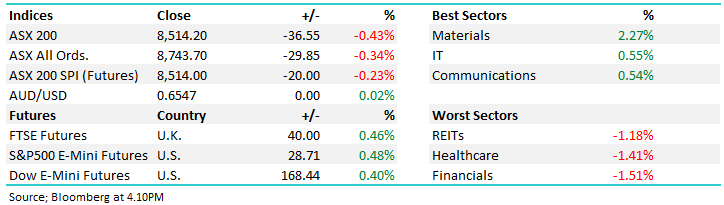

- The ASX200 fell -8pts/-0.10% closing at 8550

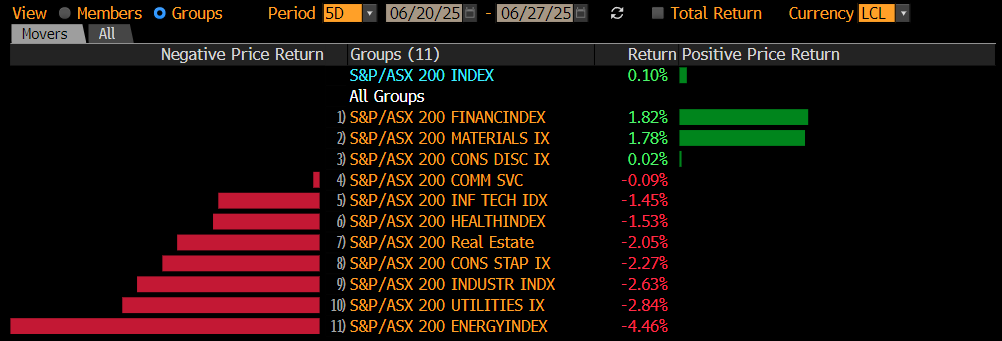

- Healthcare (+0.44%), Materials (+0.16%) and Energy (+0.13%) traded higher.

- IT (-2.05%), Property (-0.71%) and Industrials (-0.39%) fell.

- Westpac is the latest bank to bring forward their call for a rate cut, moving from August to July, inline with CBA’s call yesterday.

- Xero (XRO) -5.26% came back online post a $1.8bn equity raise at $176/sh. The stock did phenomenally well considering, after trading to a low (very briefly) of $176.06 this morning. VWAP on the day was $182.82 – we covered our view of the acquisition this morning here

- Aurizon (AZJ) -0.3% recut their FY25 earnings guidance to be underlying Ebitda of $1.58 billion, below the low end of $1.66-1.74 billion prior guide. Analysts were already expecting a miss with consensus at $1.62 billion, however they’ll come in below that level – though we suspect it’s probably more of a relief that they didn’t miss by more. Stock hit early but only a touch lower by the close.

- ARB Corp (ARB) +3.33% had a good session on a broker upgrade, Jefferies moving to a buy and $36 PT. We own ARB.

- Mixed bag in the banks with ANZ +2.2% outperforming, CBA –0.36% after hitting a fresh intraday record of $192 yesterday, while NAB-0.40% and WBC +0.09% were mixed.

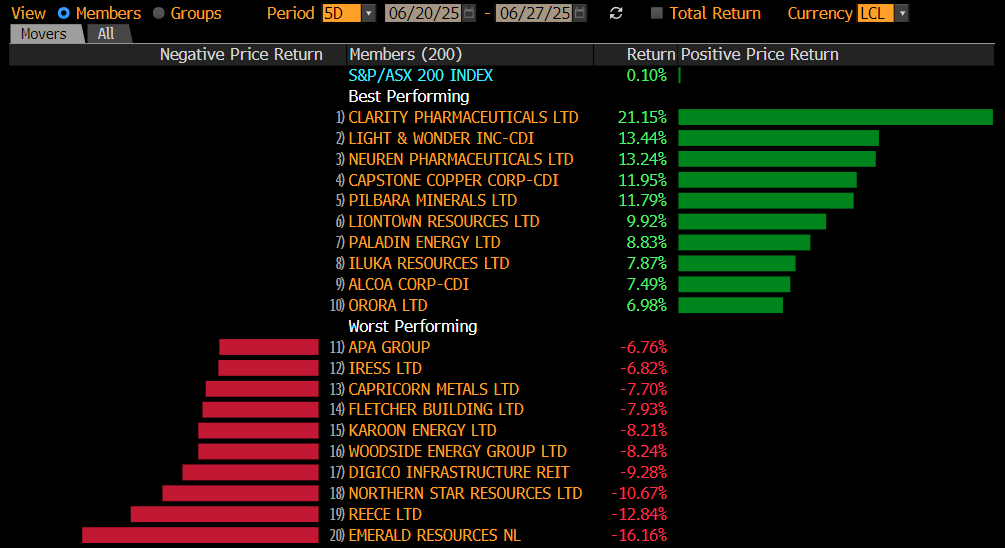

- Lithium stocks had a solid day, Pilbara (PLS) +5.62%, Mineral Resources (MIN) +3.57% and Liontown (LTR) +2.94%.

- Neuren Pharmaceuticals (NEU) +6.14% after the business announced that the United States Patent and Trademark Office had allowed its patent application for a treatment of Pitt Hopkins syndrome.

- Guzman Y Gomez (GYG) –3.31% seems to be enroute back to its IPO price of $22, the stock closing at $28.04, down from a $45 high in February. This is one to watch post August results.

- Gold added $5/oz during the session, trading around $US3337/oz at our close.

- Mixed trading in Asia, Hong Kong down -0.8%, China off –0.1% while Japan was trading up +1.6%.

- Iron Ore in Singapore mildly higher, trading at $94/mt around our close.

- US Futures are all up ~0.20%