- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

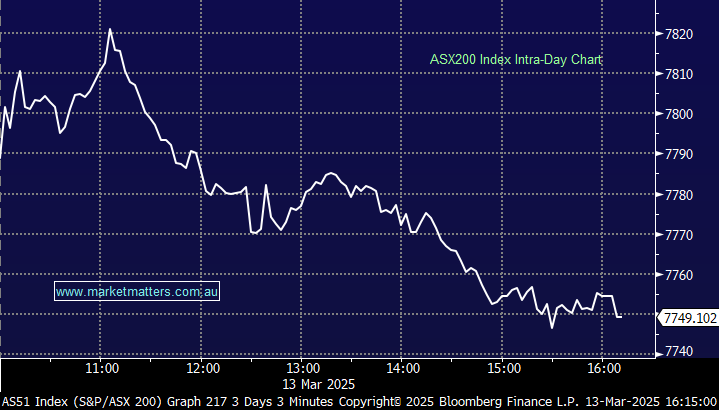

The market was higher this morning coming off a positive overnight session in the States, though, US Futures tracked lower during our time zone weighing on our market as the day progressed. The last three Friday’s have also been particularly weak so understandable that traders are nervous making any big bets on the penultimate day of the week, the index currently down ~2.5% since Monday.

- The ASX200 fell -37pts/-0.48% closing at 7749

- Real Estate (+0.04%), Industrials (-0.05%) and Tech (-0.05%) sitting on the fence.

- Consumer Staples (-0.94%), Consumer Discretionary (-0.68%) and Financials (-0.65%) weighed the most.

- Coal stocks were hit as Macquarie cut their coal price forecasts.

- That prompted them to downgrade New Hope and Whitehaven Coal to “neutral” from Buy equivalent. Whitehaven Coal (WHC) -5.78%, New Hope (NHC) -8.58% and Coronado (CRN) -5.5%.

- Yancoal (YAL) -12.56% traded ex-dividend for 53cps fully franked, equivalent to 75c (stock fell 76c).

- Boss Energy (BOE) +1.84% was up as much as 5% at one point on stronger uranium prices overnight and on news they’re upping their stake in Laramide Resources (LAM) from 8% to 18%, purchasing 22m shares for ~$15m.

- Haulage company Silk Logistics (SLH) -22.22% was hit after the competition watchdog raised concerns over DP World’s takeover bid.

- Westpac (WBC) -1.46% fell on a downgrade from Morgan Stanley, cutting their price target 6.5% to $27.30. WBC last traded at $29.63.

- Nine Entertainment (NEC) -1.54% appointed Matt Stanton as chief executive after five months acting in the role.

- Copper stocks were solid as the metal traded to new 5-month highs, Sandfire (SFR)+2.39%, MAC Copper (MAC) +2.15% and Capstone Copper (CSC) +2.11%.

- Mineral Resources (MIN) +3.03% was raised to Outperform at Macquarie with a bullish $39 price target.

- Evolution Mining (EVN) +4.03% was also upgraded by Macquarie to neutral and $6.20 PT, the stock closed today at $6.46 testing all-time highs.

- Capricorn Metals (CMM) +5.38% up as gold climbed higher, they are acquiring the Kings Find Project, expanding their Mt Gibson tenure in W.A.

- Rio Tinto (RIO) -1.06% announced they are bolstering their green energy capacity, locking in 90% of the Smoky Creek and Guthrie’s Gap solar farms solar energy production for the next 20 years.

- Inghams Group (ING) -7.29% fell as it traded ex an 11c dividend.

- Gold was higher during the session, trading around $US2943/oz at our close.

- Mixed trading in Asia, Hong Kong down 1%, China off –0.64% while Japan was trading up 0.3%.

- Iron Ore in Singapore was flat, trading around $101/MT.