SFR has become Australia’s most followed local copper stock after BHP purchased OZ Minerals (OZL) a smart move by the “Big Australian” in our opinion. For investors looking for direct copper exposure the list has shrunk and if you buy BHP or RIO the industrial metals exposure is still dwarfed by iron ore, similarly, gold stock Evolution (EVN) brings with it solid copper production it not priced as such but this is one of the reasons we hold EVN in our Growth Portfolio – we may add to this when we exit the “in play” Newcrest Mining (NCM).

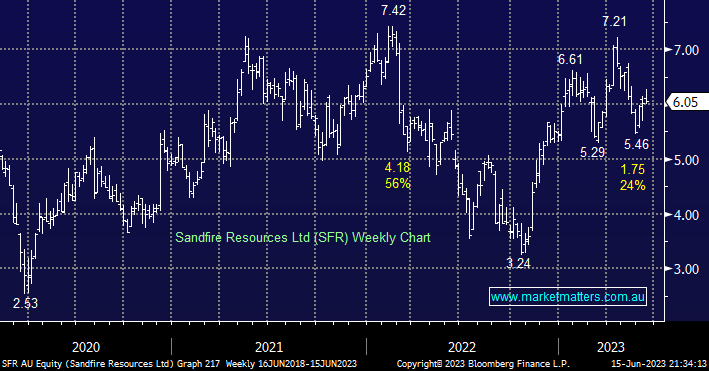

SFR got carried away rallying above $7 after OZL’s takeover hence at this stage we are accumulators into weakness not buyers of strength – at the smaller end-of-town subscribers with the appetite could consider $192mn WA-based AIC Mines (A1M) which looks good value ~40c.

- We are likely to add to our SFR position if we see another leg down towards $5 on global economic woes.