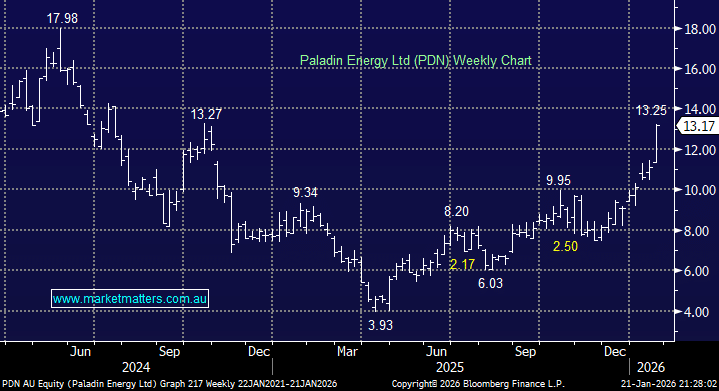

SFR has corrected almost 12% from this months high but the weakness could be quickly forgotten as copper pushes higher. The stock is no stranger to pullbacks, having already corrected over 30% once and 15% twice in 2025; it’s the nature of cyclical resource stocks. The miners’ 1Q production numbers came in 15% down QoQ but ahead of plans, and operating costs were a slight beat. SFR is set to have a net cash position in the near future, allowing it to increase focus on capital management and dividends. However, September’s quarterly report received a mixed reception, with some analysts like UBS going so far as to downgrade the stock to a sell after its strong advance, but if Cu keeps rising, their valuation models will be out of kilter – we think they are too early to the negative valuation party.

- We are looking for SFR to follow the copper price higher, with our initial target around the $18 area.