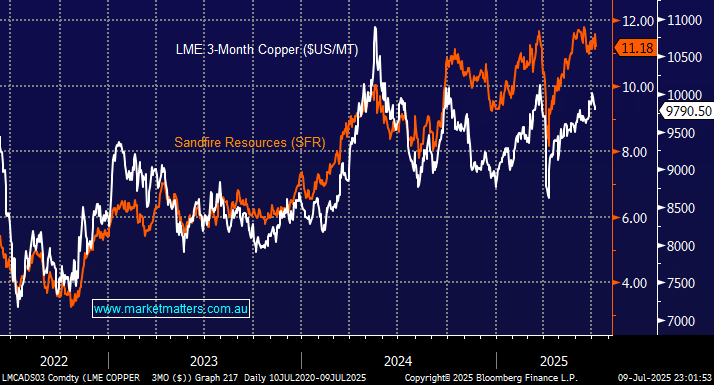

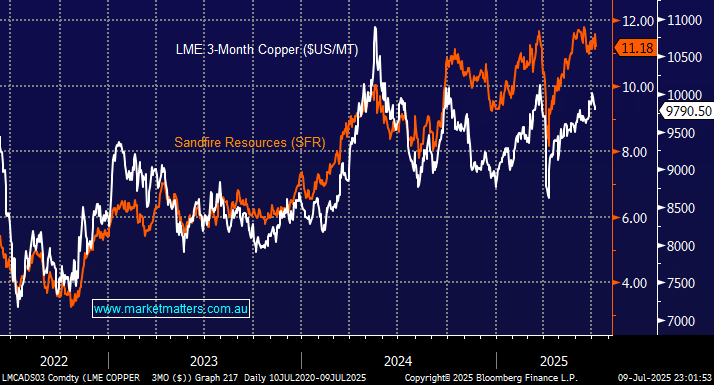

SFR has generally outperformed LME copper over the last 12-months but we felt it was getting stretched last week and trimmed our position around $11.80; good timing in hindsight. However, this is a position we don’t want to lose, per se, due to our medium-term bullish outlook towards copper. At this stage, we want SFR back around $10, with its current outperformance versus LME Cu looking stretched, but never say never, as we await good risk/reward buying opportunities.

- We will consider increasing our SFR position around $10, assuming LME copper is at current levels: MM holds a small 3% position in SFR for our Active Growth Portfolio.