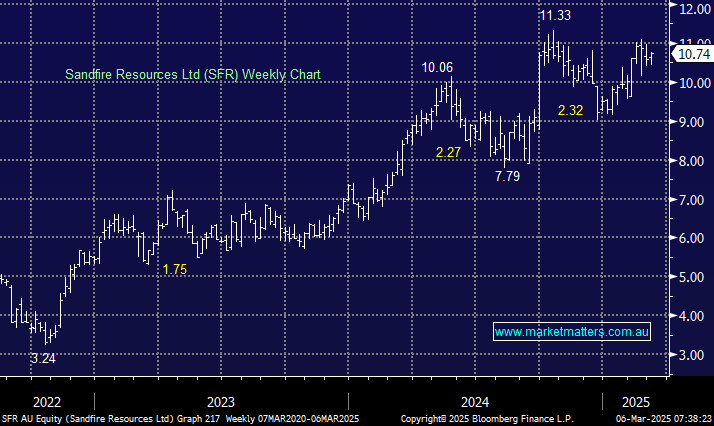

SFR has tracked the Cu price closely through 2024/5, and if we are correct, it should post fresh highs in the coming week (s). However, as we certainly know by now, commodity stocks are cyclical in nature. Although we are bullish toward Cu in the medium term, it should be recognised that the stock has already experienced three pullbacks of around 20% in the last few years. Hence, as we have done over the previous few years, we are not averse to selling/trimming SFR into strength or buying dips.

- We will reconsider our SFR position into new highs above $11.50. MM holds SFR in its Active Growth Portfolio.