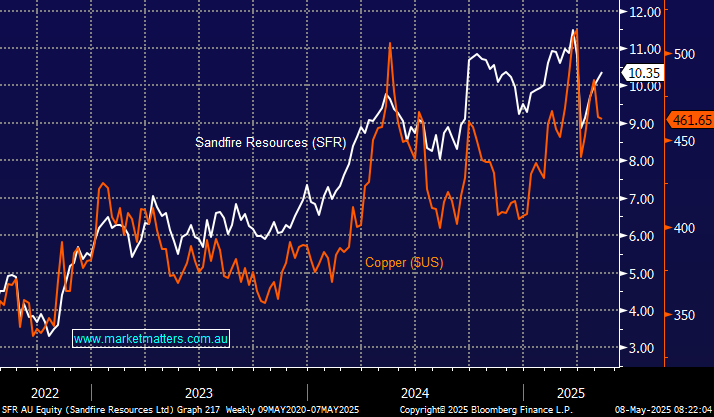

SFR has been a standout ASX miner over recent years, with Cu being the desired commodity across most major miners, i.e., BHP and GOLD. The stock is up +11.5% year-to-date, but we are conscious that consensus views can unwind sharply. However, SFR’s share price hasn’t moved out of sync with Cu. While MM remains bullish on global electrification and Cu as the best vehicle to play the thematic, SFR is likely to remain held.

- We can see SFR testing $12 in 2025: We hold SFR in our Active Growth Portfolio.