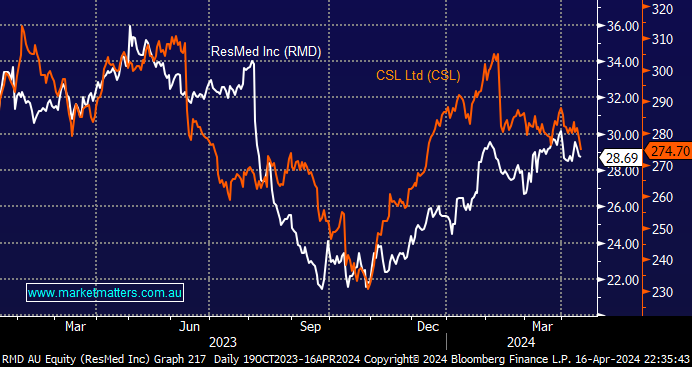

The Australian Healthcare is trading at a ~70% premium to the ASX 200 on a 1-year forward PE, which is close to its recent normal; hence, we are considering switching with the sector as opposed to outright buying or selling. RMD & CSL are two very different healthcare businesses, although both suffered in 2023 at the hands of Ozempic et al.. In both cases, the sell-off was over-blown in our opinion, but that’s the nature of stocks when the crowd runs as one:

ResMed (RMD) $28.69

The sleep disorder business RMD has been on a wild Ozempic ride over the last year, much of which can be followed through various opinions the MM website – the stock is currently up +12.8% year-to-date. RMD has bounced over 42% from its last 2023 as the news around miracle slimming drugs took a back seat in the financial pages. The question we are considering is, after its strong recovery, can the stock push through $30 until the outlook has more clarity given a wave of concerns around weight loss drugs hurting demand could surface at any time? Care is needed to assess the implications of weight loss drugs on obesity and, subsequently, the demand for RMD products, but while the rate of weight loss is open to conjecture, experts are convinced weight loss will occur.

- The new weight loss drugs set to become more readily available cannot be good for RMD; it’s just a question of how much of this impact has been priced in.

CSL Ltd (CSL) $274.70

Blood plasma giant CSL endured an extremely tough February after announcing that it was abandoning plans to seek regulatory approval for a Phase 3 trial for a cardiovascular medication. The trial was set to cost ~$850mn, and more importantly, a future growth runway had been removed. This illustrates how difficult it can be for a $133bn goliath to continue to deliver growth. MM has said previously that we believe CSL is an excellent business, but we do not feel obliged to own it; it comes down to price and relative risk/reward, so with the stock down -4.2% year-to-date its looking more attractive by the week.

CSL does still have some quality arrows in its quiver including its pipeline drug, garadacimab (for HAE), that it can add an incremental $US700m to the top line over a decade, and the Tullamarine site, which is under construction to produce influenza vaccine. Also, CSL is optimistic about capturing market share from GSK, who are not further innovating in flu, while vaccination rates are expected to rebound.

As the chart below illustrates, CSL and RMD have danced to the same tune over the last year, but we are conscious that more value has returned to CSL in 2024 and that RMD is at greater risk from the evolution of weight loss drugs.

- We are considering switching from RMD to CSL – MM holds RMD in our Active Growth Portfolio