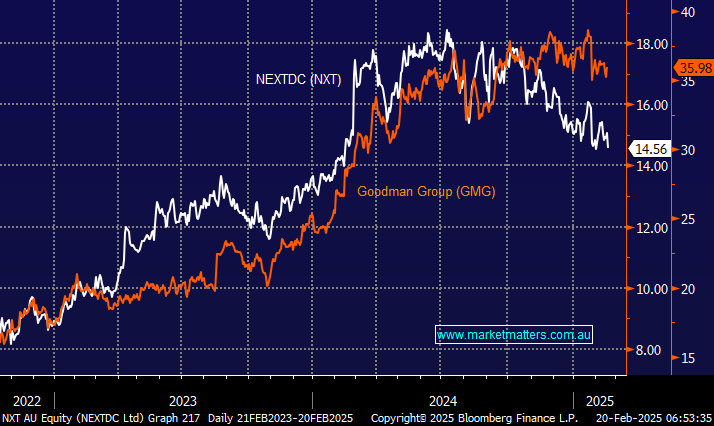

We have stated previously that MM is a firm believer in the AI revolution, which is still in its infancy. The “picks & shovels” phase, i.e., data centres and AI chips, is still an excellent place to invest at this stage of the cycle. Yesterday’s $4bn cap raise announced by GMG should come as no major surprise when we consider that in 2024, NEXTDC raised a total of ~$2bn in two tranches to develop its overall data centre pipeline; interestingly, the last raise ($1.3bn) was at a 6.8% discount to its previous trade, very similar to GMG’s discount announced on Wednesday (6.9%).

The cost of buying land and building a data centre is considerable, and subscribers only have to drive down the Pacific Highway through Artarmon to see that nothing is being done by halves. NXT’s building is one of the most impressive on Sydney’s Lower North Shore. When smart operators like Greg Goodman adopt an almost “now or never” approach to satisfying the burgeoning demand for data centres, we believe investors should take heed, especially when it coincides with our outlook for AI.

As opposed to switching from our NXT position, which has recently suffered from the ~$2bn launch of Digico (DGT) and now GMG’s $4bn raise following last year’s flagged intent to move into the space, we are looking to increase our footprint, as indeed we believe the market will over the coming years. At this stage, a pullback by GMG below its raise price of $33.50 would be ideal, but we have to be flexible and evaluate the appetite for yesterday’s significant placement – the message at 11am on Wednesday was the “books covered”, six hours before the 5pm deadline for local investors. Hence, at least this morning, our targeted buy level for GMG may be too optimistic.

- We are keen buyers of GMG into weakness – MM owns NXT in its Active Growth Portfolio.