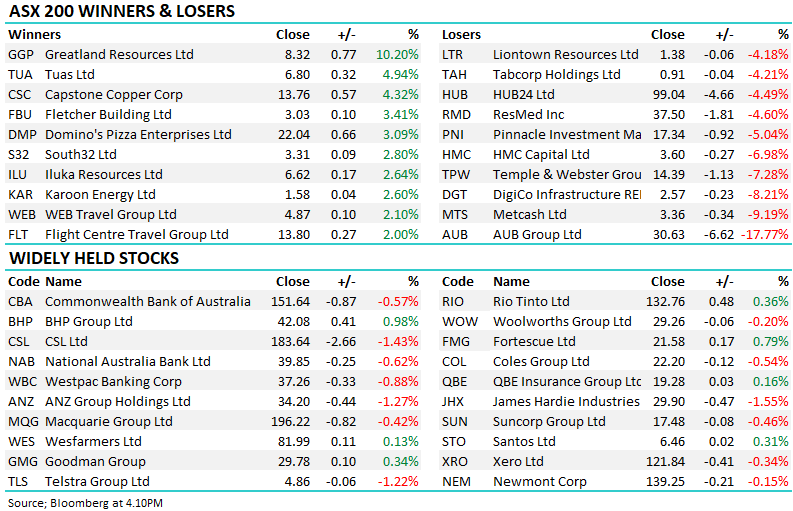

MGR has been a strong performer through 2025, advancing by +25%, while the previous sector darling, Goodman Group (GMG), has slipped by over 10%. We believe MGR will struggle compared to much of the market in the run-up to Christmas as credit markets price out several rate cuts that were expected a few weeks ago. In what we believe is a well-timed move, yesterday, UBS upgraded GMG to a buy as it becomes increasingly comfortable with the company’s data centre funding strategy.

From a valuation perspective, MGR is now trading on the rich side, whereas GMG is spending some rare time in the cheap corner.

- We like MGR, but it will lose some of its appeal as the market moves up the “risk curve.” Conversely, GMG looks like great value compared to recent years: MM is long MGR and GMG in our Active Growth Portfolio.