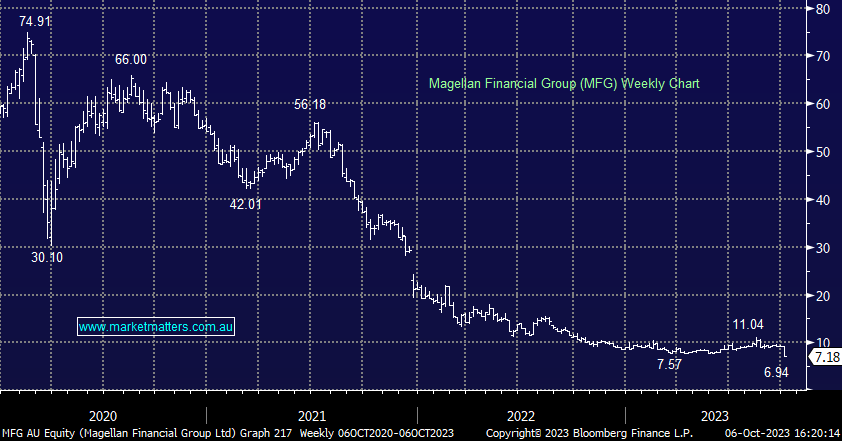

MFG -18.5%: Endured a very tough session today following the resumption of big outflows exacerbated by weakness across financial markets in September. Total FUM dropped from $39bn to $35bn, over 10%, made up of $2bn in net outflows and $2bn due to market weakness. Unfortunately, details under the hood are light but we make the following assumptions/observations as owners of the stock:

- Our bullish thesis was predicated on improving performance stemming outflows, and in the time leading to inflows – it looks wrong today.

- Principle investments account for around ~$5 worth of value, meaning the FUM business is priced very cheaply.

- Stemming outflows, however, was critical, and they’ve clearly lost another institutional mandate in September.

- Performance remains key, -$2bn of market-related declines implies clear underperformance in their global strategy wherever we draw the lines.

- Performance impacts flows + it impacts performance fees. Without stating the obvious, it’s the lifeblood of an active manager.

- MFG had turned the performance corner at their last update, today’s number suggests otherwise.

The points above imply the thesis is broken on MFG, and that might be so, the shares are screaming that we’re wrong, however, a ~$300m reduction in market cap does seem excessive. We will again reconsider our holding over the coming days.