We met with Sandon Capital last week, an activist shareholder agitating for change at MFG. There are a couple of angles to this, however, their rationale for owning MFG is very similar to our own, which revolves around the following:

- There are two parts that make up the value in MFG:

- Cash & investments held on their balance sheet.

- The fund management business.

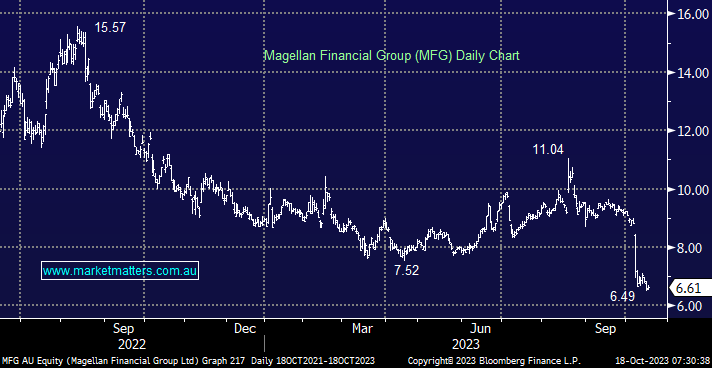

- Most analysts have a base case for cash & investments worth between $5-6 per share. At the low end, that now implies the funds business is $1.61/sh of the total.

- Before their last FUM update, MFG shares were at $8.81, implying the funds business was worth $3.81/sh. The subsequent decline in the share price implies a ~50% drop in the value of the funds business when total FUM went from $39bn to $35bn. An oversized reaction in our view.

- At current prices, investors are buying $35bn of funds under management for ~$300m, or in other words, the funds business is being priced on less than 3x earnings.

The angle being pushed by Sandon is a simplification of the business, a realignment of remuneration to incentivise new management, and a focus on building trust through the products they already have rather than focusing on growth and at the same time, launching a more widespread capital management initiative – this all makes total sense to MM. To read how Sandon will be voting at the 8th November AGM – read their letter dated 16th October to the company here.

- While we don’t get wedded to positions at MM, and we are very conscious of maintaining an appropriate position size for the risks of any one stock, we think MFG at current levels represents clear value. NB: We are down 13% on our position in the Income Portfolio & 18% in our Growth Portfolio