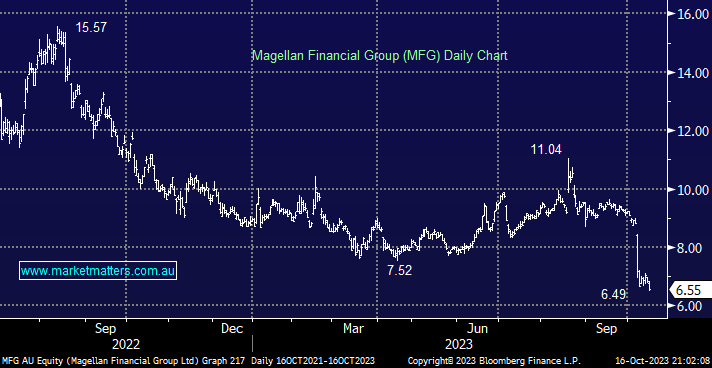

MFG fell another -4.1%, making it the day’s 7th worst-performing stock after the company announced it was considering converting their $2.65bn global closed-end fund to an open exchange-traded fund in 1H of 2024 – good for fund investors but not so good for the fund manager. This move should see the funds (MGF) current ~8.8% discount to NAV narrow over the coming months. The much-discussed options in the fund (MGFO) soared to 2.3c. They have 137 days until expiry, and if the options expire worthless, the $140mn liability on MFG’s balance sheet evaporates, but if the discount to NAV narrows to ~7.5%, the options have value which may see MFG have to finance the 7.5% discount to acquire the assets – when it rains it pours.

- We continue to believe that MFG is relatively cheap, but we will not consider increasing our position until FUM stabilises for longer than just a few months.

- Not surprisingly, we are often asked, “When would you get out?” today, any bounce toward $7.50 would see us reconsider our position.