In August, MFG announced the acquisition of a 29.5% stake in Vinva for $138.5m. This is an interesting deal for MFG on several levels given that Vinva is not your traditional fund’s management business, and MFG was not simply buying funds under management (FUM) on the cheap to help scale, which is the more typical path for a fund manager i.e. what Regal Partners (RPL) is currently attempting with a bid for Platinum (PTM).

- In broad terms, Vinva is a systematic investor, with an investment edge built on technology, underpinned by complex algorithms that can decipher information and enact that edge quickly, efficiently, and at scale.

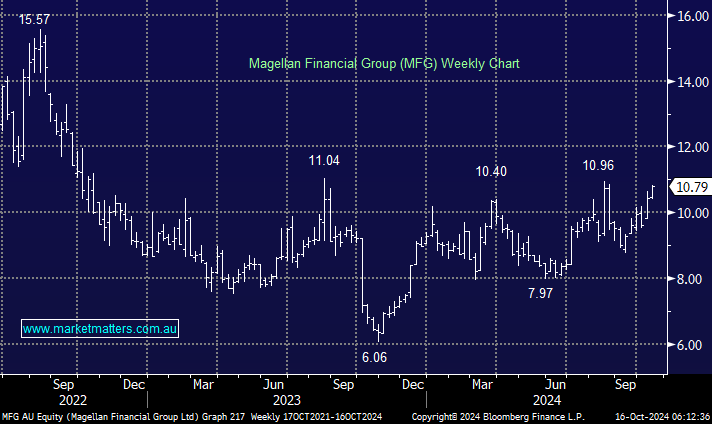

Vinva manages ~$20bn in a range of domestic & international equity funds, having previously been involved in options market making on the ASX – we dealt with them in that capacity. They haven’t been growing FUM in recent times, and the easy conclusion is MFG paid a very high price for the stake, something like 20x PE on an assumed $20-30m profit base, a very high multiple on face value. MFG themselves are still trading on 13.8x, even after rallying ~50% in the past 12-months.

The key to this deal is performance. Vinva has a fantastic performance record, where MFG have struggled recently, causing well-documented outflows. It’s clear to MM that MFG has bought intelligence in a highly specific area rather than FUM in a world where technology is becoming more engrained in investment markets. The significant change of tack here should also be appreciated. MFG’s history was built on the stock-picking of one talented individual, however, with this purchase, MFG has now officially moved on from that era.

We think this is a great acquisition for MFG. With their global distribution network and ability to leverage Vinva’s technology, they’ve now got a very strong and unique message to underpin their next iteration, built on a robust performance-orientated culture.

- MFG’s decision to buy a stake in Vinva should not be underestimated, which is certainly the case at the moment. Mainstream analysts are universally bearish on the stock; there is not a single buy rating currently on MFG.