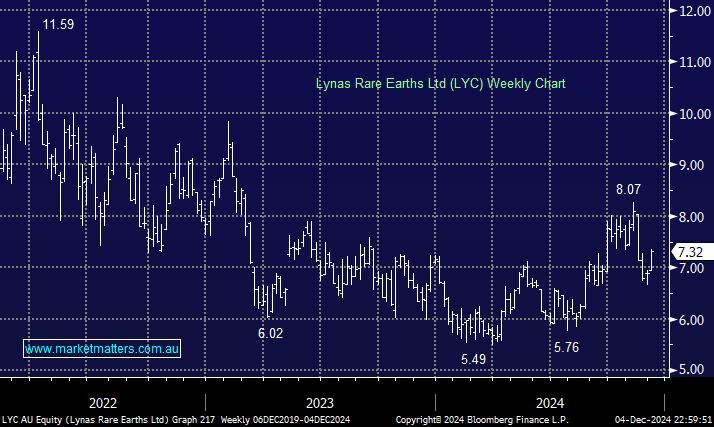

LYC popped +5% on Wednesday after enduring a tough few weeks following its Q1 update in November, which showed an 11% quarterly decline in revenue, coming in at $120.5 million. The biggest issue for LYC is arguably their significant cash burn due to declining revenues on weaker rare earth prices, particularly for neodymium-praseodymium (NdPr). The company’s cash reserves were reported at $413 million as of September 2024, a decrease of 54% compared to the previous year.

- We like the idea that the LYC provides an alternative to China for rare earths, but their financials aren’t exciting, with the risks of a trade war looming courtesy of Trump.

- LYC has now announced that it aims to produce separated Heavy Rare Earths (HRE) products from CY25. However, we are wary of HRE’s opaque nature, which is even less transparent than NdPr.