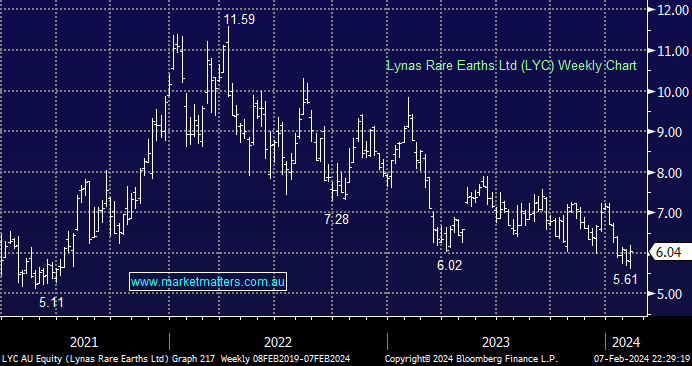

LYC is the largest rare earth supplier outside of China, but the market is a volatile one, and prices for the company’s high-value NdPr have been under pressure for the last few quarters in line with a weak Chinese economy, i.e. like so many commodities the world’s 2nd largest economy is the largest consumer. With prices threatening a decent recovery, LYC’s earnings will follow, aided by the added capacity on the back of the Malaysia licence deal sealed last October. Also, with ~6.7% of LYC shares being held short, there is plenty of scope for a squeeze higher on short covering alone.

- We like LYC as a bullish China proxy, but opted for ILU yesterday, although both offer good risk/reward after deep corrections – LYC reports on the 27th of February.