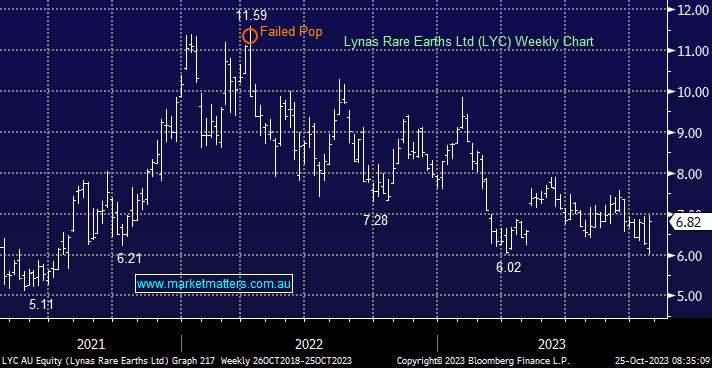

The rare earths company surged late yesterday following headlines announcing the Malaysian Government had agreed to extend the company’s operating licence to continue processing production out of their Mt Weld mine in WA. The decision is a big win for Lynas, they now have a processing facility in place to continue operations as normal while their new Kalgoorlie facility comes online. The end result will be far greater capacity to supply rare earths, where Lynas remains the largest supplier outside of China.

The rare earth market is a volatile one, and prices for the company’s high-value NdPr have been under pressure for the last ~6 months. Rather than sell into a soft market, the company increased stockpiles last quarter. Prices have already started to recover, and earnings will follow, particularly with the added capacity on the back of the Malaysia licence deal. With ~5.5% of shares short-sold, we expect yesterday’s rally to continue in the short term as shorts get squeezed.