LLC has endured an awful few years, it’s hard to believe this company was a market darling a decade ago. The company’s focus short term is balance sheet orientated as opposed to earnings but we ultimately believe the latter will follow. They have reportedly completed a “Presold Lendlease Apartments Cashflows” transaction which is estimated to deliver $550m plus other sales are looking likely such as the potential full or partial sale of the communities business (~$1bn of capital held at historical cost, expected to transact at a premium to book).

The business appears to already have its balance sheet journey in hand with our bullish view for LLC resting on the profitable delivery of the $17.9b pipeline of development work in progress (WIP) i.e. the stock appears cheap if no further disappointment is in the offing.

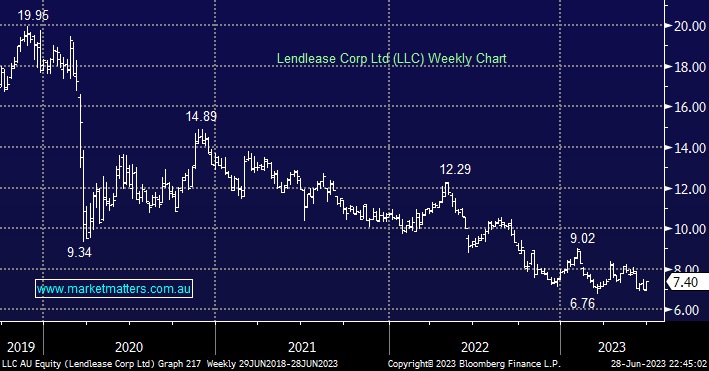

- We like the risk/reward towards LLC believing the next +20% is far more likely to be on the upside.