International Equities Portfolio – Amendments

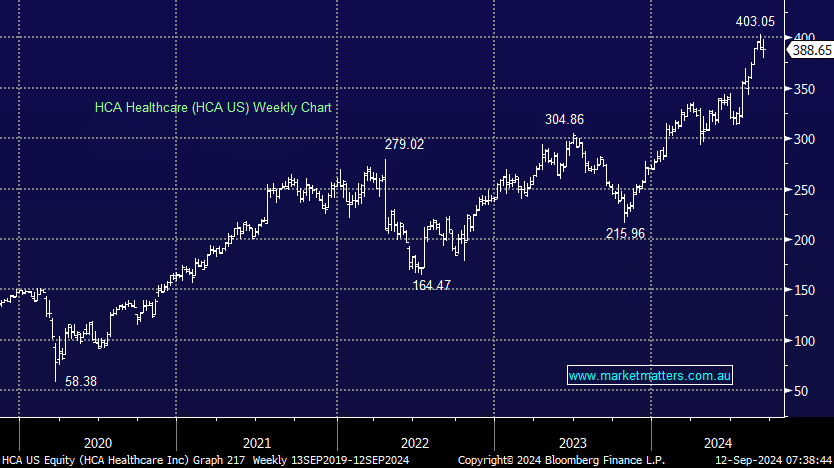

We are taking profit on HCA Healthcare (HCA US) on valuation grounds and signs that the earnings recovery is now complete.

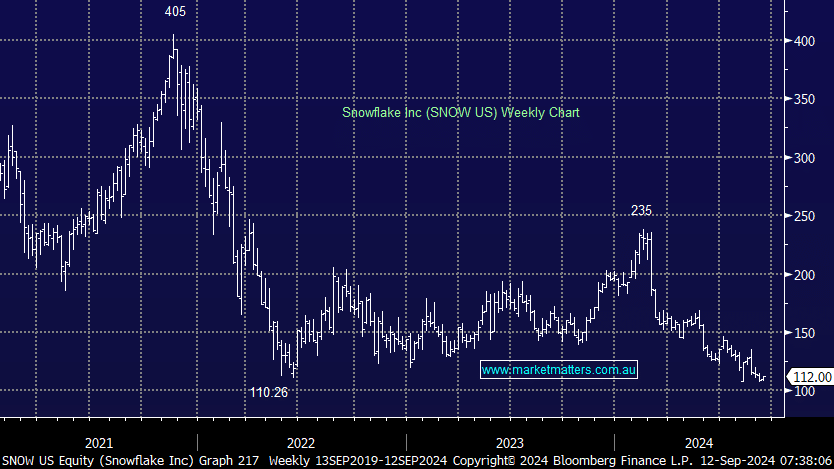

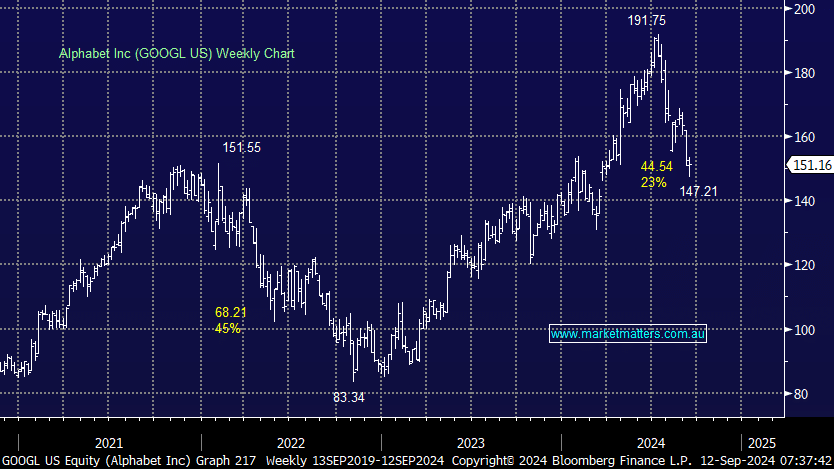

We are selling out of Snowflake (SNOW US) given the potential lag between new investments making a contribution to earnings. We see better opportunity in Alphabet (GOOGL US) following a ~20% correction in share price.

We are using a 20% correction in Alphabet (GOOGL US) to initiate a position. Whatever way we think about AI, data underpins it. Companies with deep levels of data are at an incredible advantage over those without, and there is no company on earth with more data than Google captured through its dominant search engine and ownership of YouTube. The valuation is now appealing relative to future growth.

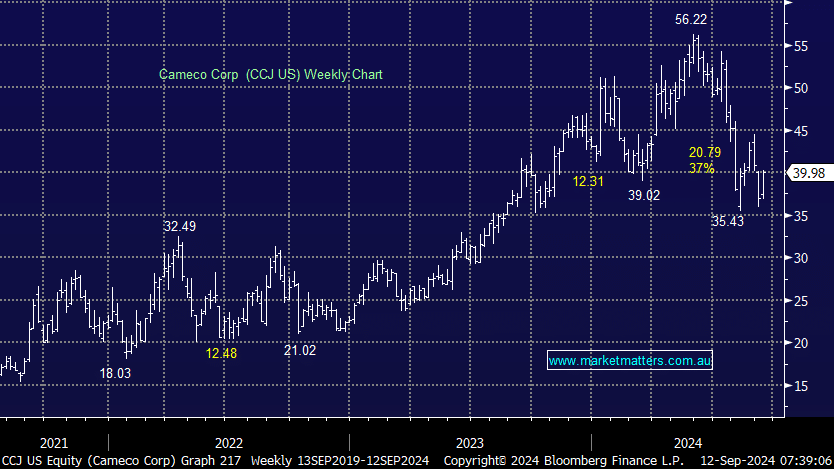

We are adding to our existing 4% holding in Uranium company Cameco (CCJ US), increasing by 1%, targeting a 5% portfolio weighting, using weakness to average our existing holding.

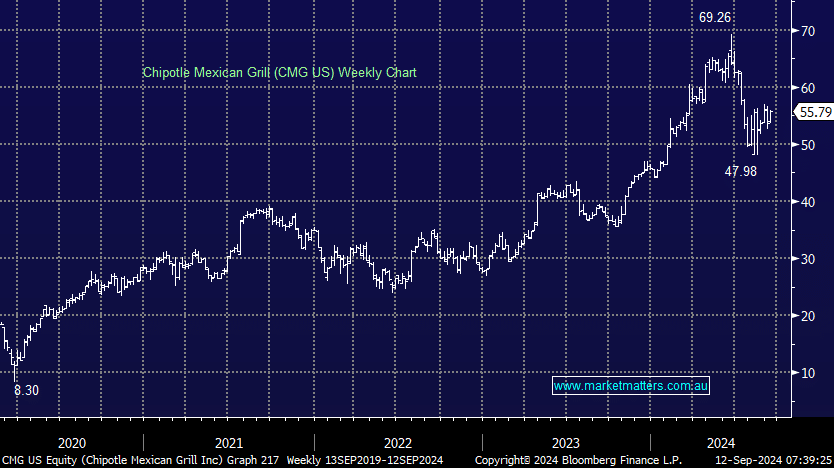

We are using a recent pullback in Chipotle Mexican Grill (CMG US) to increase our 4% weighting again, up by 1%, targeting a 5% portfolio weighting.

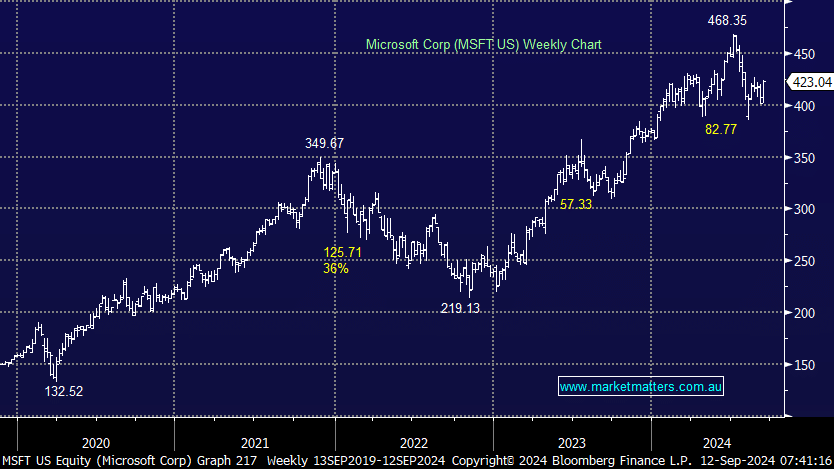

We continue to believe that Microsoft (MSFT US) is a must own global technology business, and with a recent pullback, we are increasing our 5% weighting up by 1%, targeting a 6% portfolio weighting.

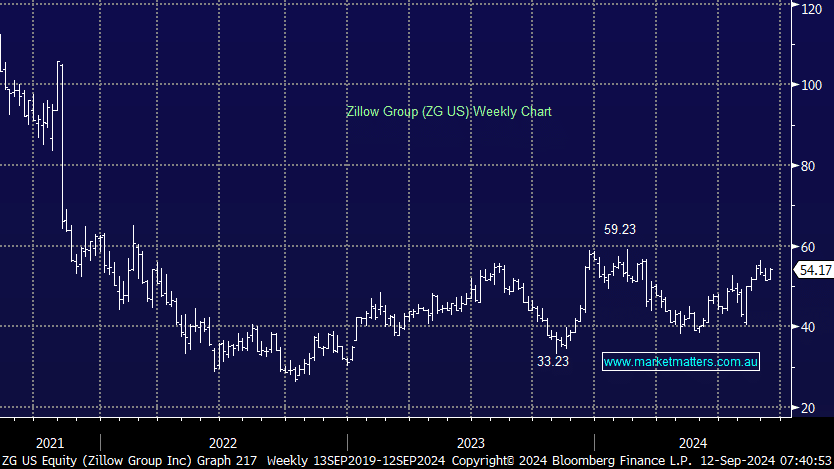

Our confidence is growing towards the turnaround in property website Zillow (ZG US), and as a result we are increasing our target weighting by 2%, from 3% to 5%.