Hi Scott,

By definition seven stocks here, below is our snapshot take on each but we are in general looking to buy this current pullback by equities:

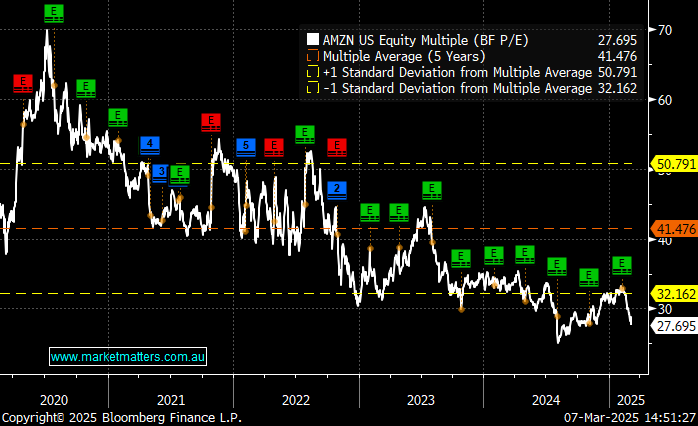

Amazon.com Inc (AMZN): Jeff Bezos has lost a few $$ of late following AMZN’s almost 19% pullback but we see value approaching ~$US200. Bloomberg have its FY25 P/E at 27.5x, in the “cheap” quartile of recent years.

- Amazon is an accumulate/buy for us.

Alphabet (GOOGL US): we like the way Alphabet is evolving as a business with its recent sell-off after Februarys result a buying opportunity for us; Specifically GOOGL shares tumbled after the Google-parent posted a cloud revenue miss as it ramps up spending on AI, worrying investors that the mega-cap technology company will take longer to capitalise on its AI ambitions – a theme that’s rolled through markets in recent weeks.

Apple Inc (AAPL US): We sold out of Apple in January and would want to stock ~$US200 be considering re-entering. Its arguably a maturing business hence we want to buy at a compelling value.

- We are neutral Apple around $US235 as it losses market share in China.

Nvidia (NVDA US): This AI chip giant has corrected 28% in almost as dramatic fashion as it rallied through 2024. Competition from China in the AI space was the trigger but we believe excellent value is approaching fast.

- We like Nvidia ~$US100 which looks increasingly possible after Thursday night’s almost 6% plunge.

Meta Platforms (META US): This is one Big Tech company that reported well this year: Fourth-quarter earnings and revenue beat expectations, with sales surging +21% year over year which drove a +49% increase in earnings.

- We like the risk/reward toward META around $US600

Microsoft (MSFT US): One of our favourite US companies and if MM had no position we would be buying now under $US400.

Tesla (TSLA): Elon Musk’s baby has fallen a whopping 47% from its December high with its founder focused elsewhere and the company losing markets share to the likes of BYD at an alarming rate.

- We are not considering TSLA.