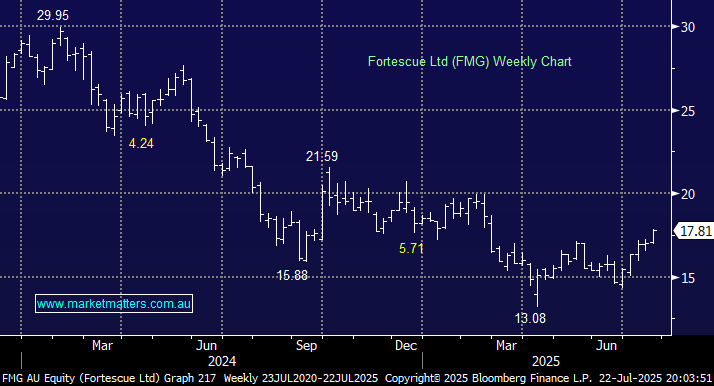

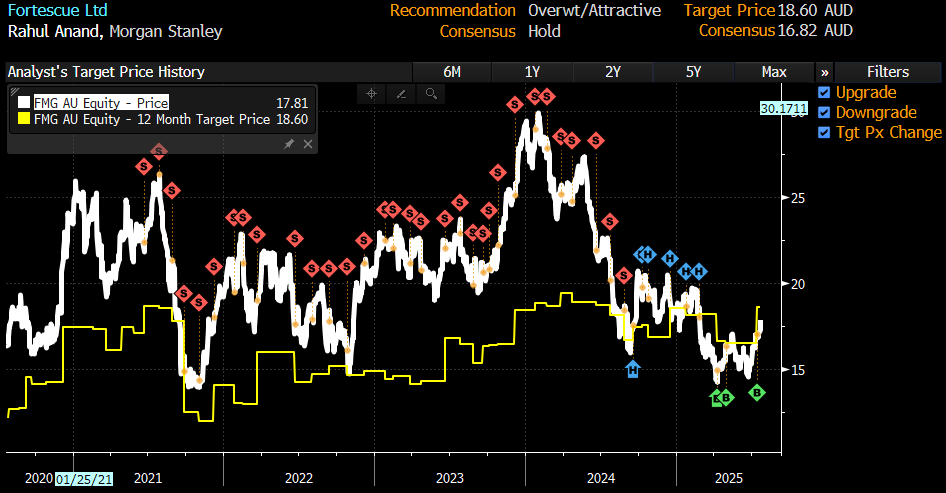

The market is lukewarm on Iron Ore stocks generally, and as a result, there is not much love for Fortescue, being the purist large cap exposure on the ASX. 66% of analysts have a hold call, 11% are in the sell camp, and only 22% of analysts have it as a buy. Rahul Anand over at Morgan Stanley is one analyst calling it undervalued with a positive view and price target of $18.60. Analyst calls need context, and having a history of their past recommendation and the subsequent outcomes from them is important.

The below chart from Bloomberg tracks the calls of the analyst over time and gives a sense of how accurate they are. We borrowed this idea for the Market Matters Website, tracking our own ‘Actions’ on a stock, frustrated by how many professionals make calls with no accountability. For those not familiar, each time we make a call on a stock, it is automatically date stamped and resides on an action tree within a specific stock page, allowing members to easily go back and look at past calls and the reasons we made them.

- The chart shows Rahul has been largely on the money, moving to a buy on the 8th April 25 with the stock at $14.82. He’s currently the No 1 rated analyst on the stock.

FMG currently trades on 12.7x earnings which is at the top end of its traditional valuation range. While it may sound counterintuitive, this is a positive sign as it implies the market has low expectations of future earnings, predicated on a bearish outlook for the underlying commodity (Iron Ore).

- Normally, buying stocks with a low PE is good, however, resource stocks are different. If they have a low PE, it means their earnings are high, driven by currently high commodity prices.

- Buying resource stocks on a high PE, generally means buying when the underlying commodity prices are low, which is more desirable.

- We prefer to be buying when commodity prices are low and PE’s are high given the cyclical nature of commodity prices

- The remedy for low prices, is low prices themselves as they disincentivise future production. The same is true for high prices which incentivise new production.

What tends to happen is if/when commodity prices start to exceed analysts’ expectations, earnings upgrades follow, and PEs can track lower when the stock price is moving higher – again, a counterintuitive thought.

We own FMG in the Income Portfolio, so yield is important. Dividend expectations vary and that feeds into a consensus yield that in our view seems too high (~7.8%). We are more comfortable expecting ~6.5% fully franked yield for the next 12-months (MS forecast 6.8%). This is clearly attractive, although unlike some of the more defensive, predictable earnings/dividend streams we have in the portfolio, it’s far from certain.

That said, we believe the undertones coming from China are now more bullish than market positioning implies, and after a tough FY25, resources are an under-owned sector on the ASX.

- We wouldn’t be surprised to see FMG squeeze up towards $20-21 courtesy of the market’s overweight positioning in the “Certainty Trade”, largely at the expense of resources.