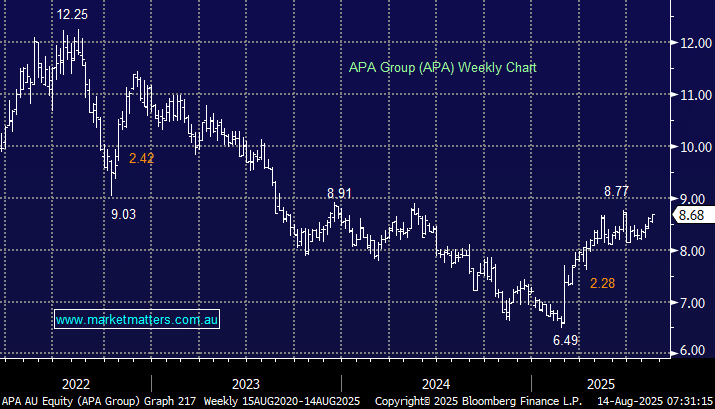

Following AGL’s ~13% plunge after it reported on Wednesday, APA was a logical place to start, with it having rallied ~30% over the last six months – it reports on the 20th. This is a regulated utility with regulated earnings, and we still expect a sustainable yield close to 7% over the next 12-months, with low single-digit growth moving forward. It is a great place to start with the cash rate on course to test 3% in 2026. The stock re-rated on the upside in February after its first-half 2025 results, when it reaffirmed FY25 guidance, and importantly, stressed they had the financial capacity to fund $1.8bn in growth capex over the next three years, i.e. no capital raise as many had feared/expected.

We like APA as a defensive, high-yielding holding in our income and growth portfolios, although risks always increase with reporting – any mention of a capital raise or dividend cut, and it could follow the way of AGL. We wouldn’t be chasing APA into new 2025 highs, and we have even discussed reducing our exposure, especially in our growth portfolio, before next week’s earnings release.

- We like APA primarily for yield into 2026: we hold APA in our Active Growth and Active Income Portfolios.