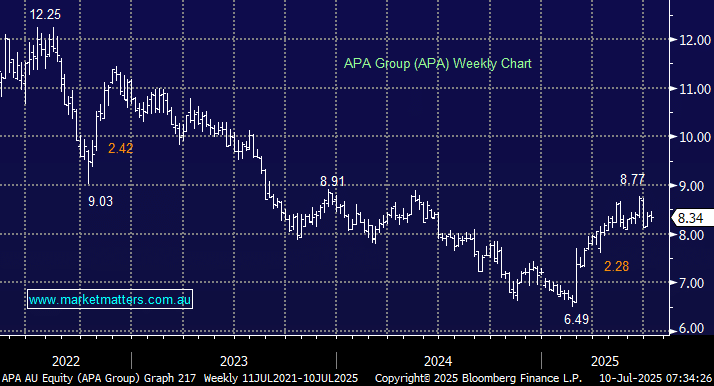

APA is a diversified energy infrastructure business, and while its core operations are heavily exposed to gas transmission, they also have electricity, renewable energy, and other energy services. The stock has advanced +20% so far in 2025 and we’ve covered APA at length along what’s been a choppy journey across holdings in two MM portfolios with differing entry levels.

The is a regulated utility, with regulated earnings, and we still expect a sustainable yield in the ~7% over the next 12-months, with low single digit growth moving forward. We still like this sort of profile for the more defensive Income Portfolio, but a cooling on the position in the Growth Portfolio. We can see interest rate cuts pushing APA towards $9 through 2025/6; hence, we aren’t selling yet, but we wouldn’t be chasing the stock into strength and from a growth perspective, we are on the lookout for better alternatives.

- We like APA but believe the “easy money” is now behind us: MM holds APA in its Active Growth and Active Income Portfolios.