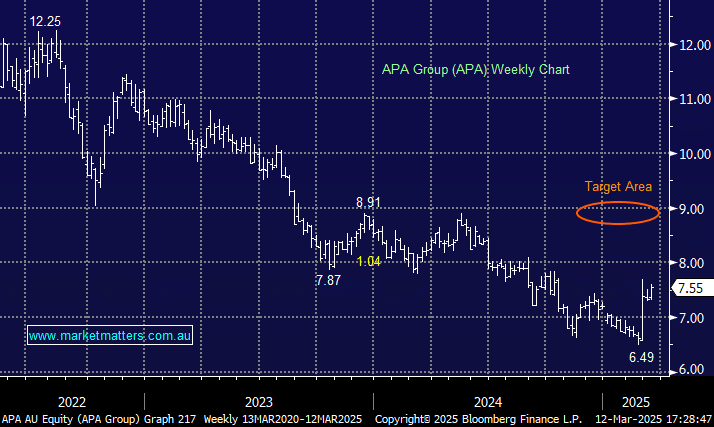

Last month’s results and accompanying commentary significantly exceeded downbeat market expectations, propelling the stock sharply higher. Unlike many similar moves, it has held the gains in reporting season and looks poised to trade higher. Importantly, APA said it could internally fund its planned $1.8bn organic growth programme over the coming three years without a capital raise. APA management is confident its steady cash flow of ~$560mn and balance sheet capacity can comfortably fund its expansion plans.

APA is set to yield ~7.5%, forecast to grow steadily over the coming decade. Credit markets are currently pricing the RBA Cash Rate to fall toward 3.5% by Christmas, making the regulated utilities yield even more attractive moving forward.

- We believe APA still represents excellent value ~$7.50 and own the stock in our Active Income and Active Growth Portfolios.