ANZ doesn’t report its half-year and pay its next dividend until May, but they delivered a solid 1Q trading update this morning as new CEO Nuno Matos continues to exert his influence on the bank:

- Cash profit for the 1Q came in at $1.94bn driven by higher revenue (+1%) and reduced costs (-8%).

- For the full year, consensus is for $7.31bn in profit, so the 1Q run rate implies they are tracking around ~6% ahead.

- 1Q Net Interest Margin was up 3 basis points – a good outcome.

- Cost reduction is obviously good, but as a customer of ANZ, we have felt to impact of mass redundancies

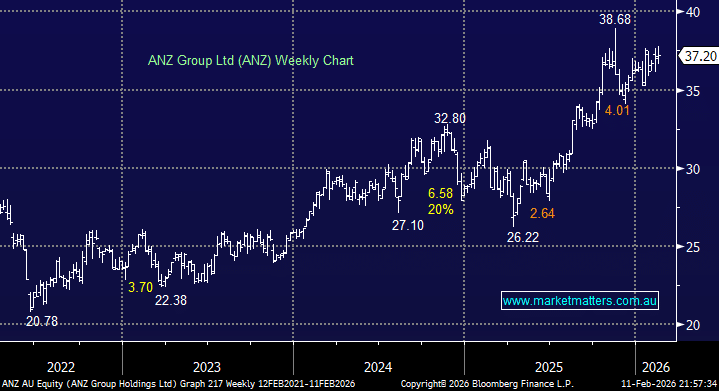

Yesterday the stock advanced +1.3%, lagging slightly, but still within striking distance of its all-time high. It’s been the best performing ASX bank over the last year, up 19%, and importantly, outperforming BEN by a whopping 34%, BOQ by 18%, CBA by 17%, NAB by 9% and WBC by 3%. ANZ should trade higher on this morning’s update.

- We are continuing to target new highs up around $40 for ANZ over the coming months, or 8% higher – MM holds ANZ in its Active Growth Portfolio and Active Income Portfolio.