The NABPF has been in the portfolio since 2019, however, around current levels the margin sits at 1.24% over the 90-day bank bill (based on market prices) which we deem as too low. We are slightly reducing our exposure to Hybrids in this portfolio from a relative pricing perspective, with the NAB note screening ‘expensive’ above $106, using funds to increase exposure to equities.

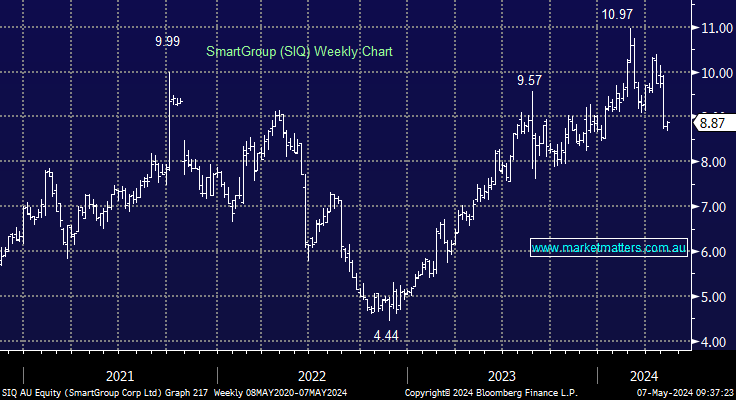

We are stepping up and buying salary packaging business Smart Group (SIQ) following recent weakness. We have had SIQ on our Income Portfolio Hitlist for some time, waiting for a solid risk/reward buying opportunity, which is now in the offing.

Super Retail (SUL) has had some recent headwinds, including legal disputes with past employees and softer retail trade is some business units, however, we believe this is now captured in the price.