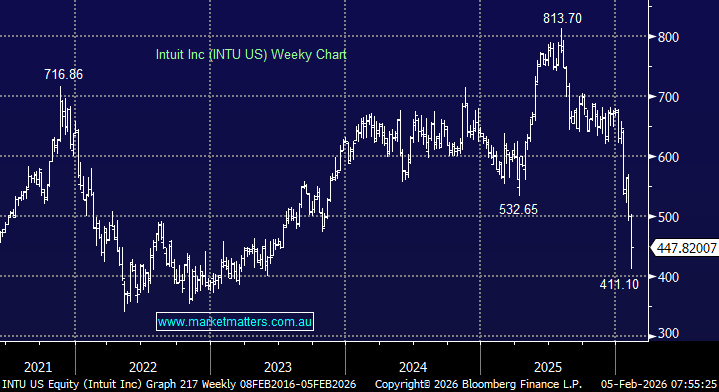

Firstly, XRO’s US rival Intuit bounced more than +3% overnight, not meaningful in the scheme of things but it suggests this will be a better morning for XRO following its almost 16% plunge on Wednesday. The provider of QuickBooks looks set to consolidate in the $US400-450 area after its valuation has contracted to 18x from a 5-year average of 31x; growth has largely been taken out of the stock as opposed to contraction being priced in.

Xero has gone from hero to zero in just nine painful months. There have been a few issues here compounding the general AI-driven sell-off across the software space:

- The stock was, and still is, trading on a high multiple pricing in high levels of future growth, which may or may not eventuate – more uncertainty around it now.

- In late 2025, XRO bought Melio for US$2.5bn, a US B2B payments platform, a strategic move to scale its presence in the North American market and broaden its software and payments offering, a deal which looks expensive in the current environment.

Xero (XRO) still looks expensive – it always has – given strong growth assumptions, which they have historically delivered on, however, the current state of play has clearly created an added level of uncertainty at a time when they’ve just made a big play into payments, via the acquisition of Melio. In the current environment, long-duration growth stocks are on the nose and with AI adding fresh uncertainty around software moats, there’s simply less margin for error and investors have acted accordingly. However, we believe XRO did deliver this week with its trading update, with a couple of key takeaways:

- Melio de-risking faster than expected: Management guided to Melio EBITDA breakeven in 2H28 (run-rate), 6–12 months ahead of expectations. This supports further re-rating potential. Melio is seen as materially undervalued on a standalone basis.

- Growth drivers intact and US synergies skew improving: Management flagged a larger share of the $US70m synergies coming from US Accounting subs (vs Melio attach), a positive validation of the acquisition.

- AI monetisation is a potential sector catalyst: XRO plans AI monetisation from FY27e (bundles, add-ons, usage). Surveys indicate SMEs are willing to pay ~8.5% more for AI, supporting SaaS acceleration rather than margin pressure.

We continue to like XRO, believing it will be “too hard” for small businesses like MM to move away from XRO using AI due to the need for transaction data and banking infrastructure required to disrupt the accounting software business. While we acknowledge our re-entry after selling in mid-2025 was way too early, we aren’t keen to sell XRO around $80.

- We believe XRO can successfully grow earnings in the US via Melio, which focuses on small business payment solutions, and strategically complements Xero’s SMB-centric accounting platform.