- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

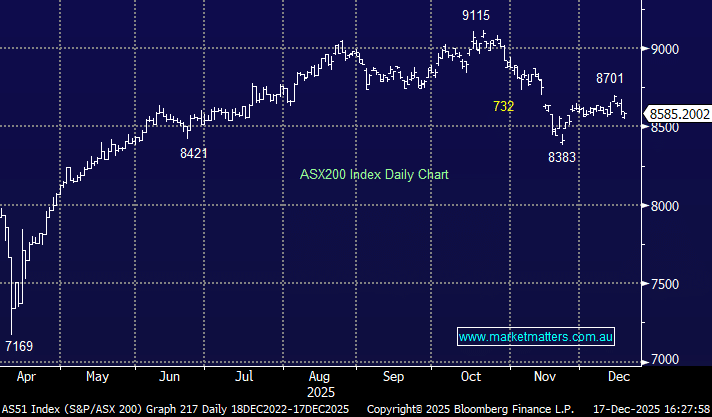

The ASX eased on Wednesday as softer oil prices and muted implications from US labour data was largely offset by strength in gold miners. We’ve got two more trading sessions before the majority of the market head for Christmas holidays, with next week’s trade likely to be very quiet. Low volumes are one of the key reasons why stocks typically do well towards the end of December, with no large portfolio selling decisions likely. So far in December, the ASX is down 0.4% relative to a 20-year average December return of +1.18% – we have some work to do.

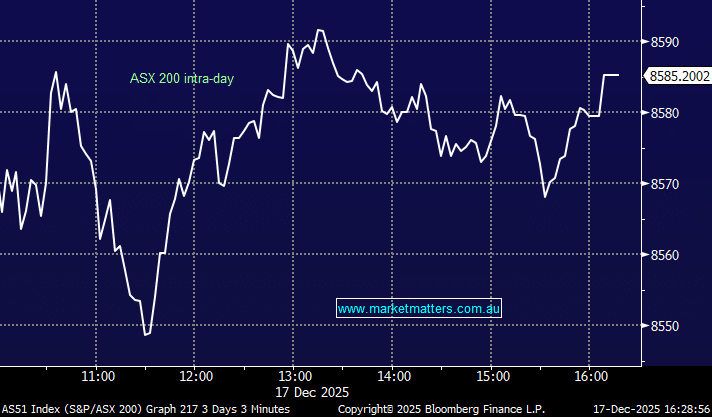

- The ASX200 fell-13pts/-0.16% to close at 8585, rallying ~35pts from the 11.30am low.

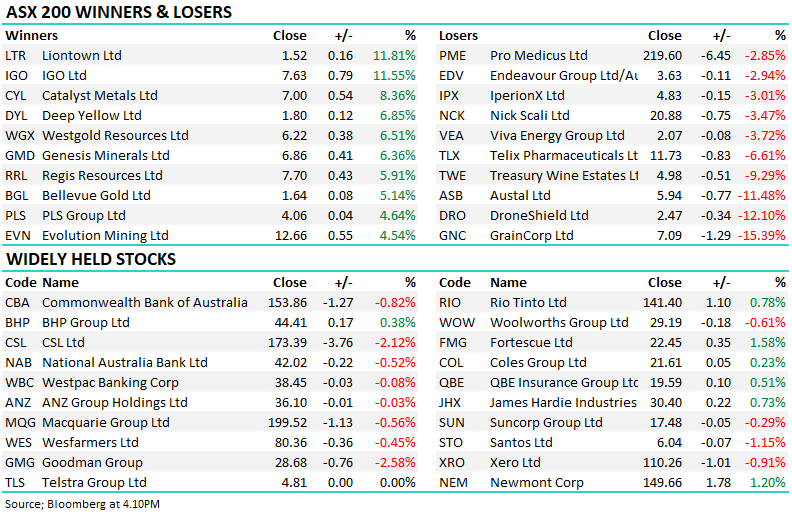

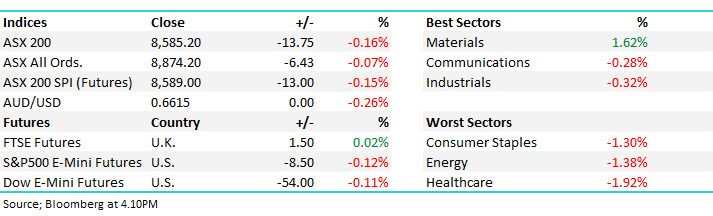

- Materials (+1.62%) back in the winners enclosure and the only sector that made

- Healthcare (-1.92%), Energy (-1.38%) and Staples (-1.3%) the weakest links.

- Energy stocks were hit as oil slid to its lowest level since 2021 on expectations the Ukraine war could end. Santo (STO) -1.1% and Woodside Energy (WDS) -2.4%

- Santos also announced the conditional sale of its 42.86% interest in the Mahalo JV to Comet Ridge.

- The prospect of easing geopolitical tensions hit defence names, with profit-taking evident DroneShield (DRO) -12.5% after a sharp two-day rally as well as Austal (ASB) -11.5%.

- Treasury Wine Estates (TWE) -9.3% on a profit downgrade, with recut guidance ~30% below consensus

- GrainCorp (GNC) -15.1% after selling its GrainsConnect Canada stake at a loss and warning of a weaker east-coast harvest.

- Gold miners rallied as spot gold surged above US$4300/oz: Newmonst (NEM) +1.1% Northern Star (NST) +3.3%, Evolution Mining (EVN) +4.2% and Bellevue Gold (BGL) +5.1%.

- Westgold Resources (WGX) +6.5% jumped as Alicanto Minerals sold 81% of its W.A Mt Henry asset for ~$64.4m.

- Humm Group (HUM) +10.6% after Credit Corp (CCP) -3.1% launched a takeover proposal.

- Telix Pharmaceuticals (TLX) -6.6%, extending recent weakness despite Citi reiterating a buy rating

- Sandfire Resources (SFR) +1.2% after confirming development potential at its Black Butte copper project

- Gold was up $US34/oz at US$4335/oz.

- Iron ore was up +0.9% at $US103/mt.

- Asian markets were largely unchanged, with China up +0.1%, Hong Kong flat and Japan down –0.1%.

- US futures are lower as markets brace for delayed US employment data.