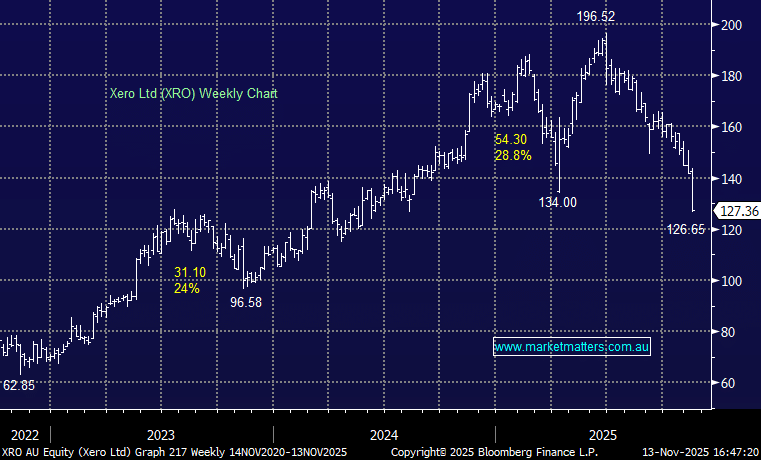

XRO -9.03%: not a good day for the accounting platform, with weak price action ahead of today’s 1H numbers proving to be on the money.

While XRO delivered a reasonably tidy 1H26 result — nothing dramatic, broadly in-line on revenue and EBITDA, the focus turned to the earnings (Ebitda) minus capex miss, which reflects stepped-up investment in AI and product capability. Subs growth was a touch soft across most regions, but average revenue per user (ARPU) helped cushion the blow.

- Revenue: NZ$1,194m, a slight –1% vs consensus.

- Ending subs: 4.59m (in line with cons.)

- Adjusted EBITDA: $351m (+1% beat vs consensus)

- EBITDA minus capex: $161m (–6% vs consensus)

Operating performance broadly fine, but cashflow softer as capex moves higher. From a high level, this was “okay” but okay is never enough for these sorts of growth stocks. Growth in North America was a key point of interest ahead of this update, and to that end, it was a touch light on, adding +19k subs (21k expected) with subs in the region now standing at 419k. NA revenue of $72m was also ~8% below consensus and when overlayed with higher spend on new features, earnings – capex came under pressure.

In terms of the Melio acquisition, they provided pro-forma numbers, with revenue +62% YoY and net adds of +7k tracking ahead of expectations.

The growth in the overall ecosystem still stacks up, and todays result is not thesis changing in any respect, but a reminder that winning in this new AI world comes at a cost – and there is uncertainty around how their strategic plans (incl Melio) will pan out.

- Overall, a weaker update but we think the share price reaction is too severe, particularly given the weakness leading into today’s 1H result.