LYC is where most local investors go in the local market for exposure to rare earths. This $13bn established giant of the sector is highly exposed to NdPr (neodymium/praseodymium) prices. In FY25, LYC produced $556mn of revenue with $1.1bn forecast in FY26, but again, this is highly dependent on NdPr prices. In FY25, Net profit after tax (NPAT) fell sharply to $8mn, down from ~$84.5mn a year earlier, due to a large depreciation expenses relating to the expansion of its processing facilities at Kalgoorlie and Mt Weld, along with its sensitivity to rare earth prices. In August, LYC raised $750mn at $13.25 to fund expansion as western firms responded to Beijing’s supply shock with buyers up almost 70% at one stage last month, but now they’re back to square.

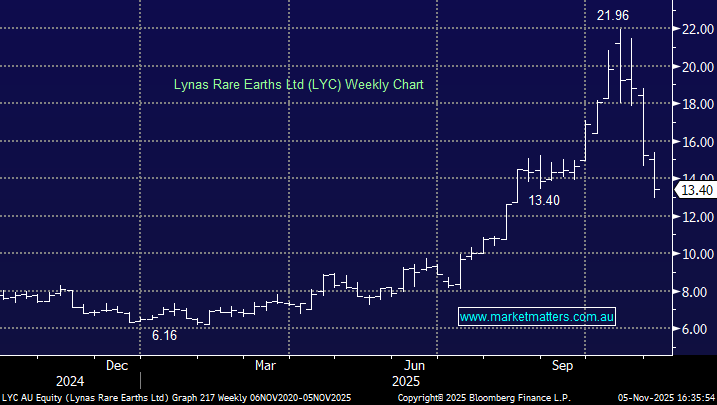

The initial moves by China and subsequent responses have significantly benefited LYC’s share price in 2025, although, as the chart below shows, it’s been a volatile journey. Lynas has reported a strong start to FY26, with 1Q sales reaching ~$200mn, up from $170mn in 4Q25. The company is ramping production, with rare-earth oxide output increasing ~20% quarter-on-quarter, and with global demand for rare earths, particularly for EVs, magnets, and critical minerals, expected to rise, the key profitability levers are poised to be pulled.

- We like LYC around $13, but it’s not for the faint-hearted, being so dependent on NdPr prices.