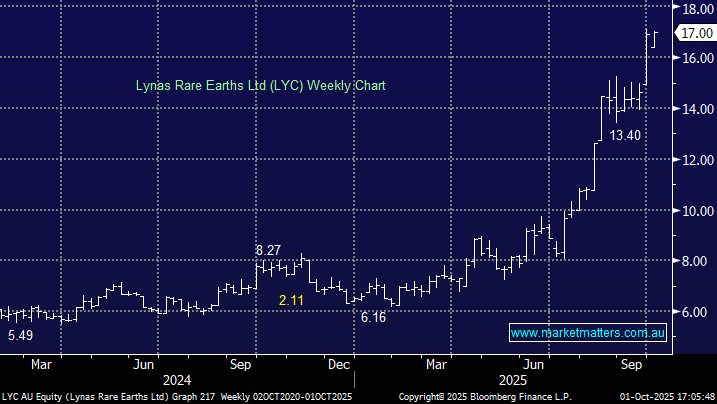

In August, LYC successfully raised $750 million, which involved the issuance of approximately 56.6 million new shares at $13.25 per share, representing a 10% discount at the time. Not surprisingly, with the stock at $17, there was strong demand for its SPP, and the company has more than doubled it to over $180mn, filling all applications in full. It’s refreshing to see loyal shareholders well rewarded. This year’s shenanigans in the rare earths market have led countries like the US and Australia to strive to secure supply from alternative countries. For perspective, in 2024, China maintained its dominant position in the global rare earths market, accounting for approximately 70% of global mine production and controlling nearly 90% of global refining capacity.

The moves out of Beijing have, similar to DRO, placed Lynas in the right place at the right time. LYC is Australia’s largest rare earth producer and one of the world’s few significant non-Chinese suppliers, providing critical materials for EVs, renewables, and defence technologies. Unless we see a backflip out of Beijing, the market and governments will likely remain supportive of LYC.

LYCs’ market cap has now surged to more than $17bn, and while FY25 earnings were virtually non-existent, earnings are about to kick, with consensus expecting $343m in FY26, jumping to $572m in FY27 and $742m in FY28.

More broadly, LYC has announced its “Towards 2030” strategy, which it plans to execute with raised funds, and includes increasing NdPr production by around 60% to 10,500 tonnes per annum, diversification of revenue streams through Investing in magnet manufacturing facilities in Malaysia and the U.S, and strengthening strategic partnerships by engaging with the U.S. Department of Defence regarding the Seadrift heavy rare-earths processing facility in Texas. Some good ideas here, but obviously they come with execution risk.

- We like LYC, but it’s rich around $17, and we have no plans to chase the current breakout.