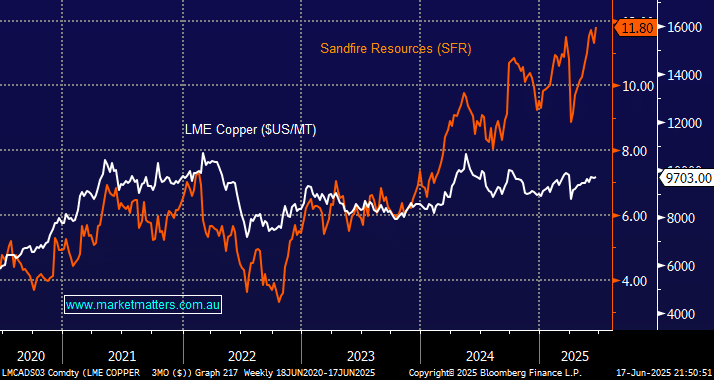

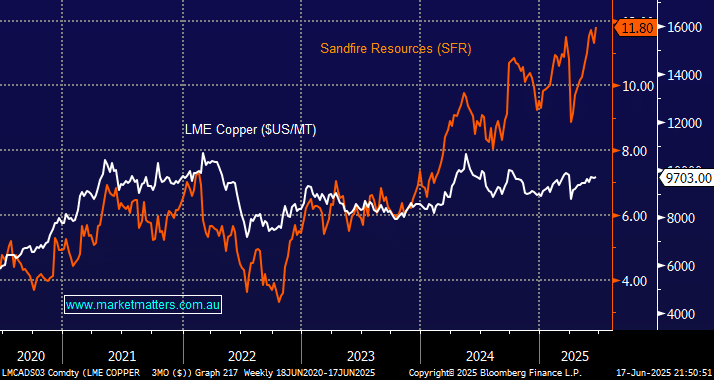

We’re all aware that commodities are cyclical and often volatile at times, we’ve seen that recently with oil, gold and uranium names. MM has discussed copper extensively through 2025, believing it to be instrumental in global electrification, from AI to EVs and the overall push toward a zero-carbon footprint. While lacklustre demand from China has weighed on prices as their economy slowly but surely turns the corner, it’s the supply side of the equation that compounds our bullish outlook. As touched on earlier, copper is currently in short supply, and the situation is expected to worsen, not improve, in the coming years. For example, BHP has voted with both feet in terms of its outlook for the industrial metal:

- BHP bought local Cu miner Oz Minerals (OZL) for $9.6bn in 2023 and failed last year in its attempt to buy Anglo American (AAL LN) for a whopping ~$60 billion.

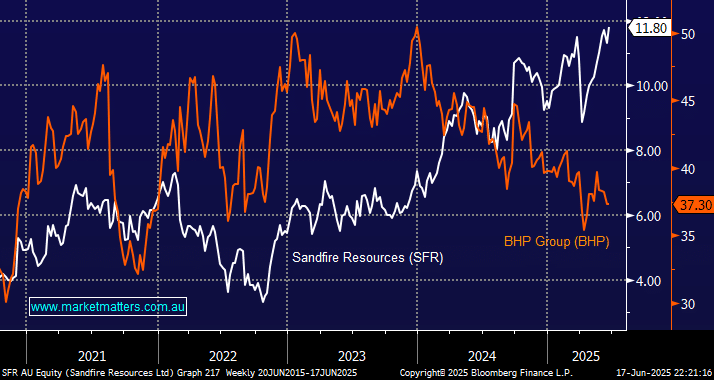

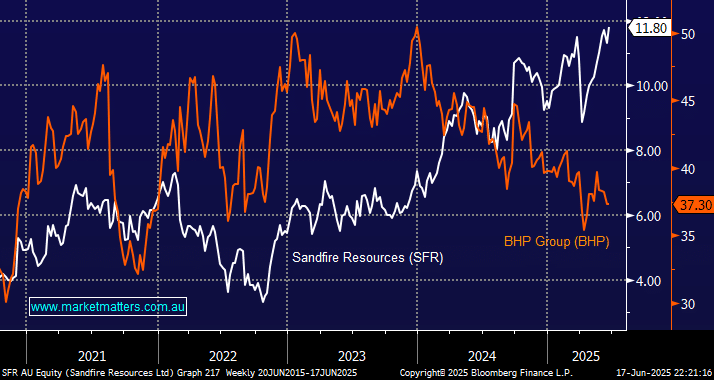

Like BHP, MM is very bullish towards copper in the coming years. The question we ask today is, after advancing by over +27% in 2025, is Sandfire (SFR) the best local vehicle for exposure moving forward?

- We should remember that MM has scaled in and out of SFR over recent years, with the miner having already corrected by over 20% four times since 2023, i.e., it has a history.

SFR is looking increasingly rich compared to the Cu price, which contributes around 85-90% of its revenue, with both MATSA and Motheo mines being primarily copper producers, with additional by-products such as zinc, lead, silver, and gold. Since BHP’s takeover of OZL, it’s been the obvious proxy for Cu on the ASX, but it’s caught our attention of late as it’s marched towards our $12 target while Cu remains below its 2025 high. If we’re wrong in the short term and the world’s economy slows down, dragging Cu with it, SFR will appear very stretched.

- The dichotomy is that we feel SFR is looking rich, but we don’t want to lose our copper exposure.

Additionally, we are aware that the $5.5bn miner could be on the radar of a suitor, as it is generally cheaper for the giants of the mining industry to acquire assets as opposed to developing new ones.

There are other alternatives on the ASX for Cu exposure but they’re not all as pure:

- Capstone Copper-CDI (CSC) – This $CAD5.8 billion Canadian miner is a pure copper play, which remains ~30% below its 2025 high as operational costs weigh on performance – we are watching carefully at this stage.

- BHP Group (BHP) – The “Big Australian” enjoyed ~28% of its total revenue from copper in FY24, and in FY25, it’s estimated to be ~33% as the miner intends to more than double how much copper it produces in South Australia over the next decade.

- Evolution Mining (EVN) – A gold-driven stock whose ~30% of revenue in FY24 from Cu shouldn’t be ignored.

At this stage, we believe BHP and EVN offer viable alternatives to SFR; it all comes down to when and where:

- EVN is driven by gold, which has been volatile of late. We are likely to increase our position if we see a test of the $8 region, with a downside “washout” possible as the market sits complacently long gold.

- BHP is being driven by the “now” as iron ore struggles with the Chinese economy, but the case for a cyclical recovery for the world’s 2nd largest economy builds by the month, and we like the runway for BHP’s evolution in the coming years.

Yesterday, it was announced that BHP and Aurizon (AZJ) had signed a long-term deal for AZJ to transport copper from BHP’s South Australian mines, assets from its purchase of OZ Minerals (OZL), which they see substantial growth, by rail and road, starting in October 2025. With SFR up over 27% in 2025 and BHP down more than 5%, we believe mildly reducing SFR and mildly increasing BHP has some merit; sometimes, small portfolio tweaks can be as valuable to adding alpha via larger moves.

- We believe that, around current levels, BHP is presenting excellent value towards copper both now and in the future, while SFR is starting to feel rich.