XRO +4.71%: An in-line result from the accountancy platform with revenue in line and earnings a slight beat.

- ANZ revenue rose 21% y/y to NZ$1.18 billion vs consensus estimate NZ$1.21 billion

- International revenue jumped 24% y/y to NZ$925.6 million.

- Earnings (Ebitda) at $N638.5m, +28% y/y vs estimate NZ625.6m

- Operating expense to revenue ratio stood at 71.8%, with annualized monthly recurring revenue up 22% to NZ$2.39 billion.

The real wins in the result were in the detail around margin and churn with gross margin increasing to 89% vs. 88.2% the year prior. Importantly, the business has been able to grow topline revenue by increasing active subscriptions, whilst minimizing attrition of its current user base – lower churn rate even as they increase prices.

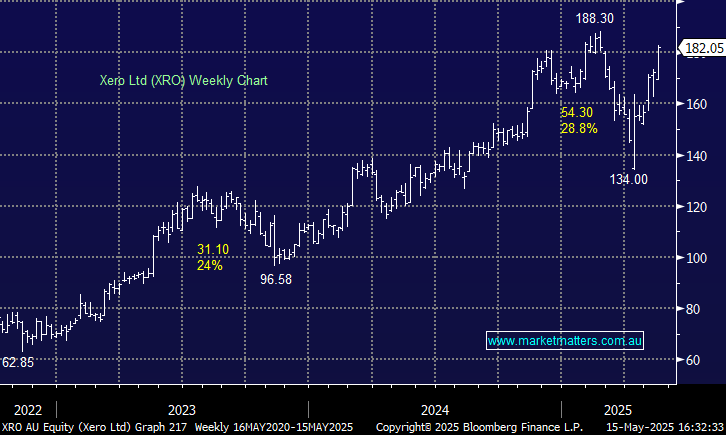

Despite short-term volatility in the share price, the global opportunity to digitize workflows for small-medium sized businesses, accountants and bookkeepers are still in the infant stages so we continue to like the stock on a medium and long-term basis.