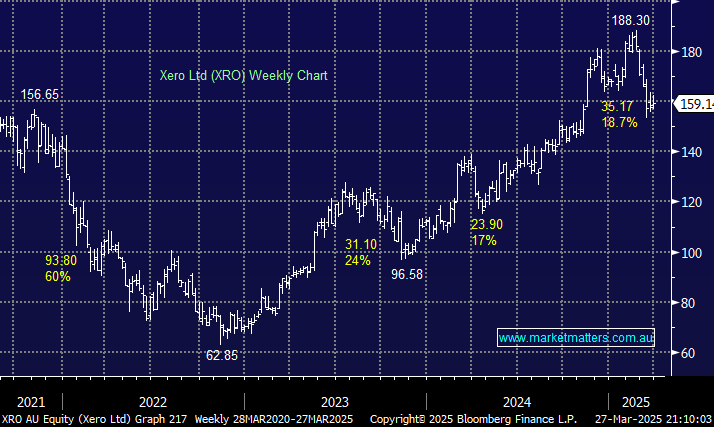

XRO is another quality business that was trading at a high valuation in February, but this has been addressed by a run for the exits across the crowded growth space, especially among momentum traders when the music stopped playing, i.e. at its worst, the ASX200 had corrected 10.2% whereas XRO fell by almost 19%. XRO cannot be described as cheap, but this online accounting business has several levers to ramp up profitability while still maintaining strong top line growth, underpinned by further upside in the UK and the US.

This is a rare tech stock which is successfully balancing growth and profitability. However, it is a stock not unaccustomed to 20% pullbacks, and while they’re delivering operationally, we believe such moves should be bought, not sold.

- We like XRO and may increase our position around the $150 level – we own XRO in our Active Growth Portfolio.