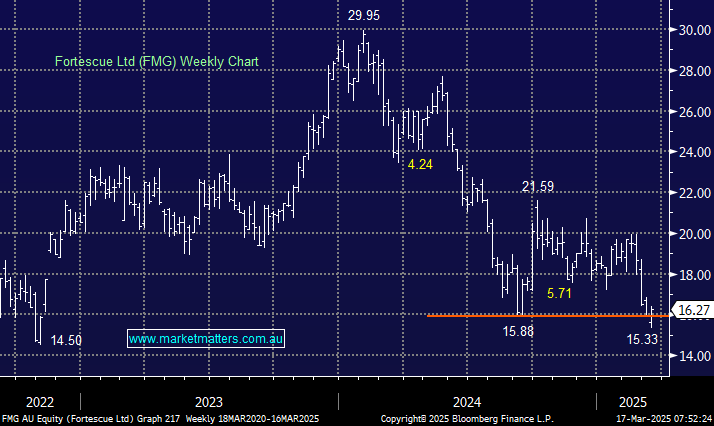

FMG is undoubtedly a volatile beast, halving from its early 2024 high, with not even its chunky dividend helping offset the capital depreciation in just over one year. However, we now believe the risk/reward favours the buyers as China looks to stimulate its way to 5% economic growth, and the ore iron price remains well supported above $US100/MT. Note: Looking forward, the miner is only forecast to yield ~5.5% fully franked, not the dizzy levels of recent times.

- We are looking for a retest of $21 by FMG through 2025, a ~30% rally from Friday’s close.