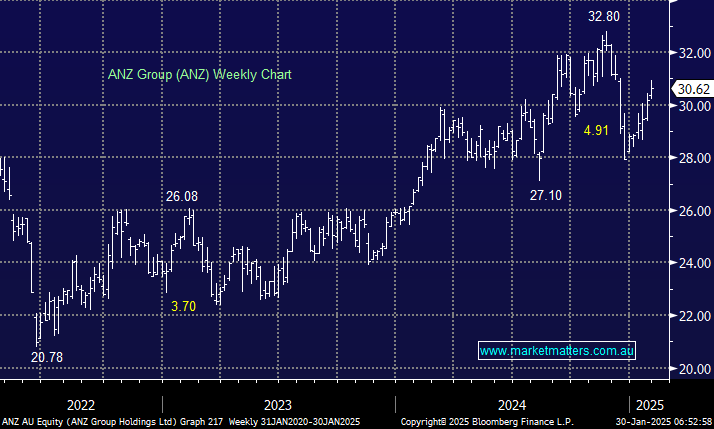

The press and pundits continue to tell us how expensive the banks are, but their prices pay little attention. ANZ is forecast to pay a sustainable 5.8% fully franked over the coming year, not bad considering the RBA Cash Rate is set to fall—note that Westpac (WBC) and National Australia Bank (NAB) aren’t too far behind.

From a valuation perspective, ANZ is our preferred option for new money, and we recently bought it in the Active Income Portfolio, at the same time, trimming CBA. We penned a note on that trade here, looking at relative valuations across the banks.

While many sight index flows and passive money driving bank share prices up and clearly that has an influence, we think the economy experiencing a soft landing has been very positive for the sector, while the prospect of technology reducing costs is another driver. Overlay a growing population which is moving towards a cashless society, and we think the sector will remain supported, though we doubt they will enjoy the same gains as 2024.

- We can see ANZ trading between $29 and $34 through 2025 while rewarding investors with a strong yield – MM owns ANZ in its Active Growth Portfolio & Active Income Portfolios.