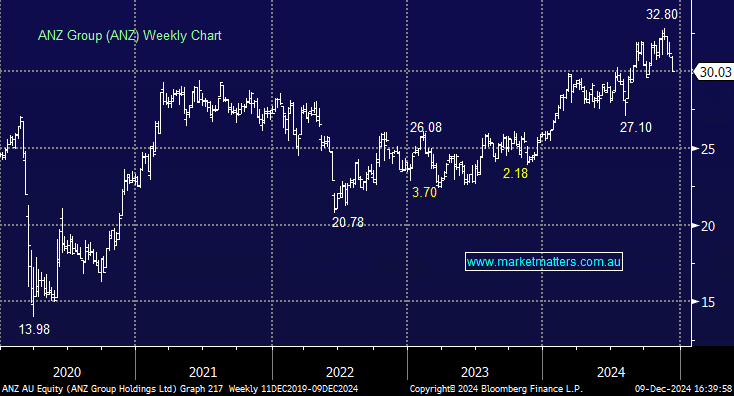

(ANZ) -3.60%; fell today on news its CEO Shayne Elliott is stepping away from the bank after 9 years as CEO. If shareholder return is a measure of success, then he’s failed to deliver, though he had a lot of work to get done steering ANZ back from a failed push into Asia courtesy of the last CEO, Mike Smith.

He went on to successfully remove circa. $1.6bn of costs from the business over the past few years and ultimately, we think Elliot has done a reasonable job simplifying the bank to a point they can now look towards adding back in a bit of complication to grow again, which they’ve done through the purchase of Suncorp Bank.

That said, incoming ex-HSBC head of private wealth and banking Nuno Matos has his work cut out for him as he deals with the integration of SUN’s banking division, as well as the continuing ASIC investigation into market manipulation carried out by ANZ bond traders.

The proof will be in the pudding, but we think bringing in someone with global experience such as Matos is a wise move for ANZ for the bank with the highest exposure to overseas markets, though it’s understandable the market has some reservations about his Australian experience. We continue to hold the stock in the Active Growth Portfolio.