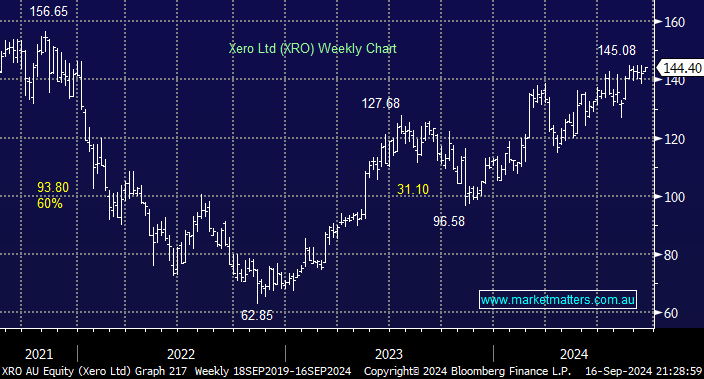

XRO continues to trade around its two-year high, and while it would be easy to grab our profits (~40%) and move on to fresh pastures, we see no reason as the business successfully pushes price hikes onto its growing number of customers. MM uses XRO, along with another 4.16m subscribers across 180 countries, and once it’s all setup, it’s hard work to move elsewhere, which equates to a sticky revenue stream.

They’re also focusing on achieving/beating the ‘rule of 40’, which is the sum of annual revenue growth and free cash flow margins at or above 40. In practical terms, it equates to a business that is growing strongly, but sustainably, with XRO leaning into its strong position, particularly in Australia with 60% market share. Only 10 years ago, MYOB was the dominant player with 80% of the Australian market, however with XRO’s growth, that number now sits at ~20% – the concept of the ‘winner takes all’ in software is clearly on display here.

We reduced our position from 5% to 4% in July on valuation grounds; we’re unlikely to repeat the move without fresh news.

- We like XRO as it trades towards its next report in mid-November —MM owns XRO in our Active Growth Portfolio.