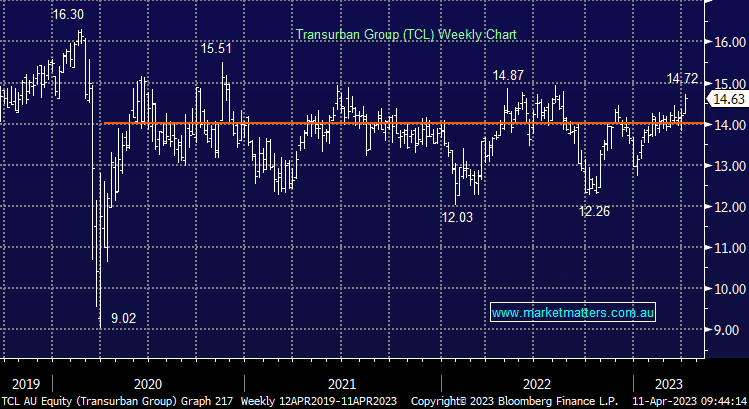

We are selling our 4% holding in Transurban (TCL) to allocate funds elsewhere. While TCL’s last result was a strong one, it’s spread over 10-year Government Bond Yields is now at historical lows, rendering it too expensive for the risk involved with a transition of the CEO.

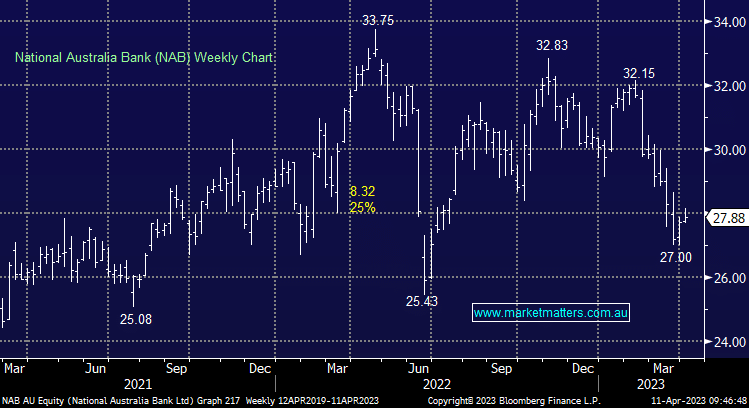

We are increasing our current weighting to NAB, taking it from a 4% weighting to a 7% weighting into the recent pullback, ahead of their upcoming May dividend.

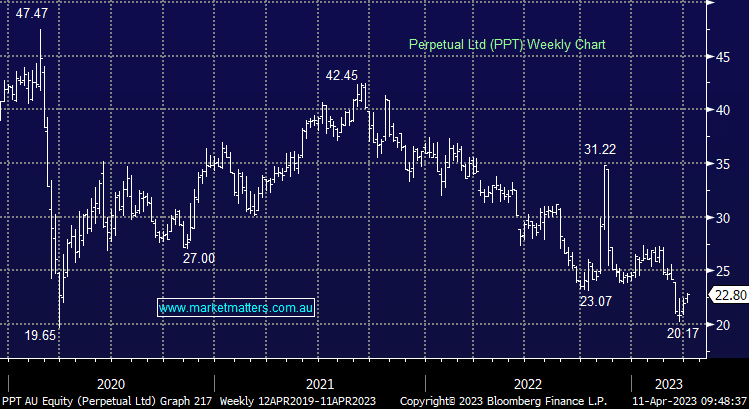

We are increasing our holding in Perpetual (PPT) by 1.25% targeting a 4% portfolio weighting. This position was acquired through the takeover of Pendal (PDL) whereby we received a portion of PPT stock + a portion of cash. We are now re-establishing the full equity position.