What does MM think of Perpetual (PPT)?

James,

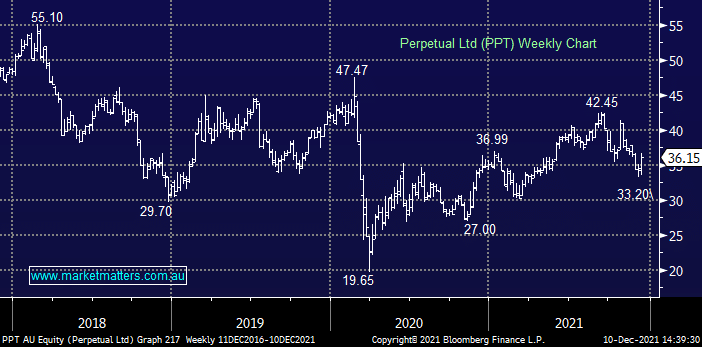

I fell into the trap of not selling a stock that is CGT Free. I inherited Union Fidelity Trustee Company in August 1995. There has been a succession of takeovers. At the most recent takeover, Perpetual acquired Trust Company of Australia in Dec 2013, and Perpetual shares were trading at $53 post-acquisition. The price has never recovered from there in spite of strong reassurances from management since then, it hit $40 or so this spring and thought that I’d cut my losses at $42 but didn’t sell, and has now tumbled to $34. I’m in despair of this company! What is wrong with it?

David G.