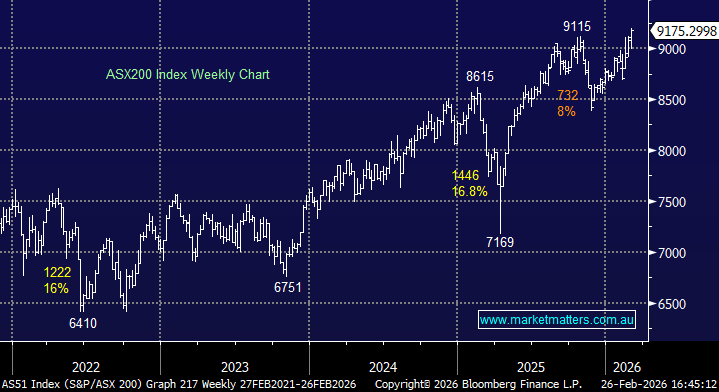

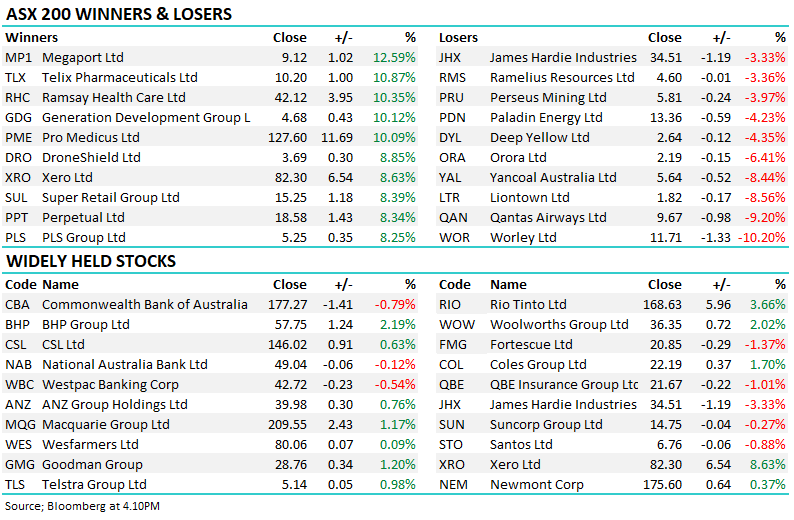

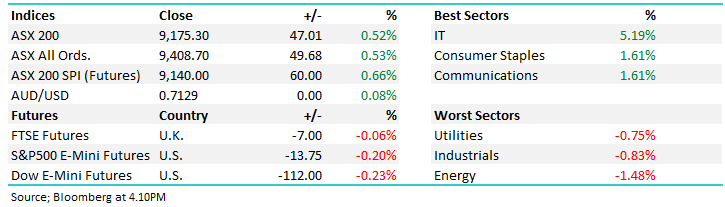

The Match Out: Earnings & BHP propels ASX towards 9200

The ASX pushed to another record close, extending its February rally with a strong bounce back in tech on a positive read through from Nvidia’s result, and the vast majority of companies reporting better than hoped earnings.