XRO -0.54% We’ve fielded a few questions on our holding in Xero in the past 24 hours, and whether or not we should hold or fold, so here’s our latest view as we wrap up the week. The simple answer at this stage is yes we are holding but we are not considering averaging which could be interpreted negatively. As we said on both Thursday Afternoon and Friday Morning we believe the reaction to the miss has been overdone and primarily driven by the market being long/overweight the stock after May’s strong earnings report, however, we are looking to reduce our tech exposure in 2024 which compounds why we don’t want to fade this initial knee jerk to the downside. A surface breakdown of the numbers:

- Revenue of $799m was only a shade below expectations, consensus for example was at $805m.

- The difference here was mostly due to lower growth in Average Revenue Per User (ARPU) – which was up 6%, we were expecting more. i.e. XRO are raising prices but they’re balancing this out with growth, but it’s a tough act.

- They did beat on free cash flow (FCF), partly due to less capex – this was a positive.

We were also very keen on seeing the outcomes of their US review, and to that end, average annual net investment in the US has been ~$30m over the last 10 years, in line with US VC backed businesses; but also, that looking ahead, it will be targeted and invest at a reasonable rate relative to top line growth generated. Our takeaway being a more measured approach, but some in the market were thinking they would do more here, that a silver bullet on the US push would be unveiled, but alas, it was not.

Ultimately, some disappointment, but we do think the business is moving towards a more solid, balanced footing as they leverage the nearly 4m customers they have globally. The main question mark in the short term comes around valuation which is key to share price, and with this week’s update, we think XRO will struggle to push meaningfully higher in the short term.

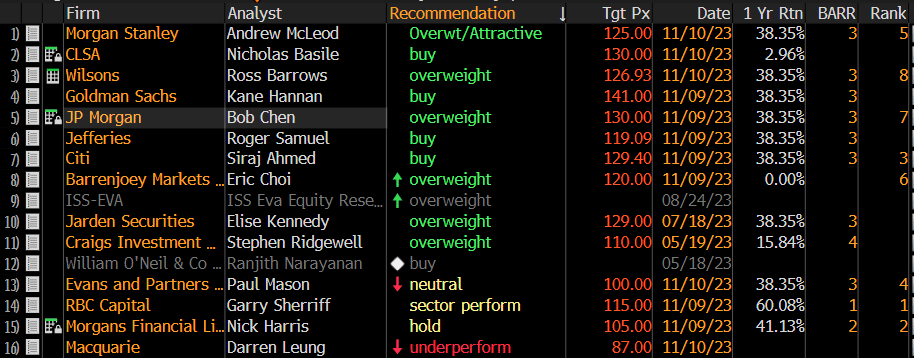

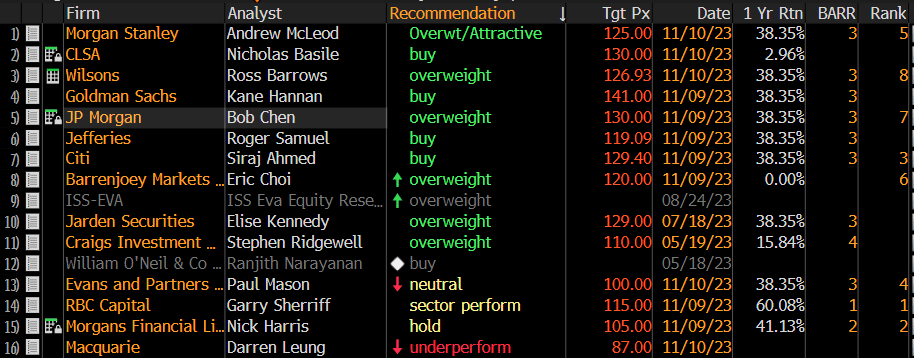

Brokers have had a mixed response, Macquarie took a knife to their forecast and became the most bearish on the stock, while the majority of others are not swayed by yesterday’s update.