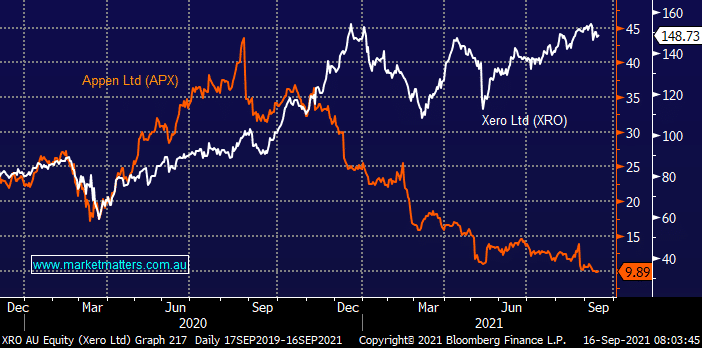

Thirdly, a dip into the volatile IT Sector where high valuation “hot stocks” can fall from grace in the blink of the high e.g. so far in 2021 APX is down 60% while Wisetech (WTC) is up 67%, even Afterpay (APT) is only up 5% after enjoying a takeover bid.

At this stage we remain long and bullish Xero (XRO) which is a quality operation but it is undoubtedly priced for success, our target area is around $160 and if APX is languishing under $10 if and when those levels are reached an aggressive switch for part of our XRO holding will be tempting, especially as APX will fit the profile of stocks which the market often chases into a Christmas rally.