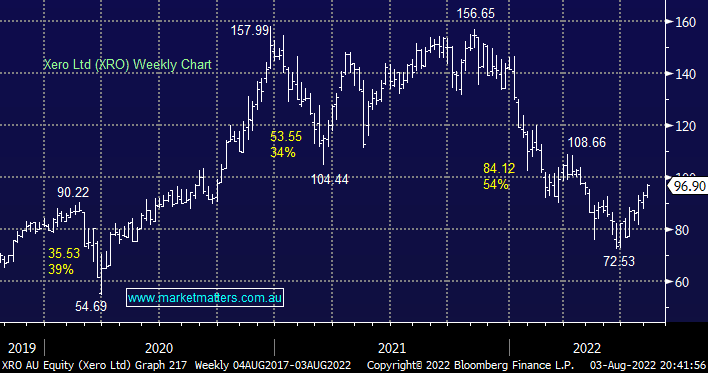

There’s no change with our view towards online accounting firm XRO as the stock rapidly approaches our initial $100 target area, we like the business but it struggled to maintain its challenging high valuation in today’s QT environment. XRO are holding their Annual Meeting on the 18th of this month while its FY23 Half Year Results won’t be presented unto the 10th of November hence it’ likely if MM acts it will be enabled by general market moves & sentiment as opposed to stock specific news.

- We hold 7% of our Flagship Growth Portfolio in XRO, we view this as too aggressive in today’s uncertain macro environment hence we’re considering trimming back to ~5%, locking in a small profit around $100.