While primarily a cloud accounting software business, Xero has been embedding AI features (bank‑reconciliation predictions, forecasting, analytics) into its platform. This shows the “AI value in existing platforms” story – companies don’t have to be building large language models; they can monetise AI by enhancing a platform and increasing value to users.

XRO stands out to MM as it offers a lower-risk way to participate in the AI platform trend (software + AI features) rather than pure AI infrastructure. Importantly, XRO has been a company we have liked and backed for years, and we’re fans of their significant ~$4bn acquisition of American accounting and payments platform Melio Payments to help the ASX software giant gain scale in the lucrative North American market, something they have struggled with over the past decade – the acquisition will almost triple its North American revenue.

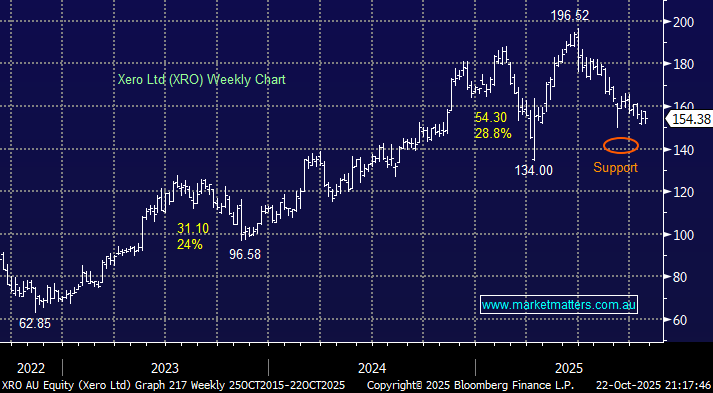

At the time, XRO raised capital at $176, which we felt was a bit rich, but with the stock now ~12% lower its providing value into this quality growth business, which is now balancing growth and profitability in a more sensible way.

Risks/things to watch:

- Growth is likely less explosive, and AI feature adoption may lag, but competitive threats from other SaaS/AI entrants and incumbents like Intuit Inc. (QuickBooks) must always be monitored. We see XRO as a more conservative approach to the “AI platform monetisation”, especially after its ~20% correction.

No. 1 pick in today’s report, with MM likely to increase its position