Following our bullish outlook for the NASDAQ into Christmas, we have reconsidered our ASX tech exposure, specifically with Xero (XRO) set to report its 1H result next month. The most interesting aspect of the upcoming result will be the stickiness of XRO’s customer base with the accounting platform having pushed through a 6% price rise across popular plans in NZ, 9% in Australia and 7-10% price rises in the UK last month i.e. have these price hikes led to greater churn? We suspect they won’t but it’s always the variable, and very important as XRO looks to further monetise their ~4.2m subscribers.

- Moving forward, we think XRO is well-positioned to increase profitability from its existing and future customer base, through higher prices and product mix, as new bundles drive the migration of customers up subscription tiers over time.

In May, XRO posted another solid 2H24 result, with a notable strong beat on free cash flow (FCF) while also delivering robust top-line growth. We remain positive around XRO’s ability to continue to grow strong FCF over the medium term, driven by continued resilience in top-line growth in the mid-to-high teens, plus improved operating leverage as the business continues to scale along with productivity movements.

There is still significant headroom for FCF margins to lift over time, with global peers already delivering an average of ~30% FCF margins. Costs are key here as XRO invests in R&D for growth, particularly in markets like the UK and the US. LinkedIn advertising suggests XRO has been hiring this year, pointing to rising fixed costs, but that in itself could be a positive, as it could reflect subscriber growth requiring customer support, etc.

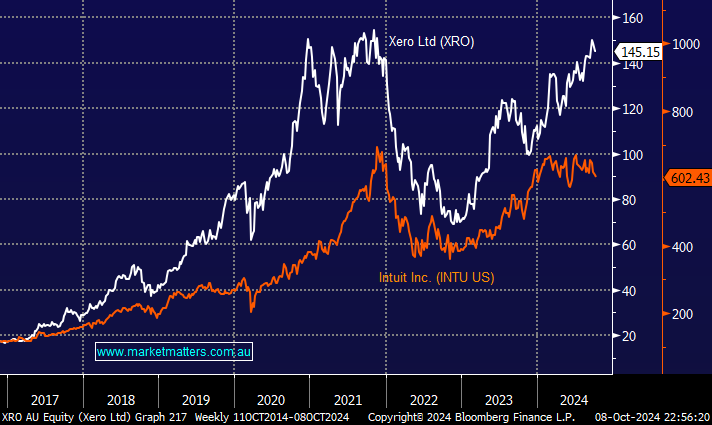

- XRO is a $22bn NZ-based cloud-based accounting software business that should do revenue of ~$1.7bn this year, and while it’s on a lofty 88x P/E, it is growing earnings strongly. At the same time, Intuit Inc (INTU US) is a ~$171bn Californian-based similar business producing $US16bn in revenue trading on a more conservative 32x valuation, growing at a much slower rate. We believe XRO’s higher valuation is justified as it expands into the UK and the Americas.

August’s AGM outlined the company’s objective to capture a significant portion of the largely untapped $100bn global market. The existing numbers are already exciting, hence the stock’s high valuation: XRO added 419,000 new subscribers over the year, up 11%, while the average revenue per user (ARPU) was up 14% from FY23. XRO remains a tremendous long-term opportunity due to its growth runway; with ~4.2 million subscribers, Xero is only beginning to scratch the surface of its incredibly large total addressable market (TAM), i.e. there are ~100mn small/medium-sized businesses that could benefit from their services.

- Similar to the NASDAQ, we are targeting new all-time highs for Xero (XRO). MM is long XRO in its Active Growth Portfolio.