SFR -1.34%: delivered a mixed December-quarter update, with production slightly softer but earnings materially stronger.

Dec Q Production:

- Copper production 24,074 tons, -2% q/q

- Zinc production 26,767 tons, +20% q/q

- Silver production 1.2 million oz, +9.1% q/q

- Capital expenditure $58 million, +7.4% q/q

Group copper-equivalent production was 36.6kt, down modestly on last year (37.3kt), impacted by planned maintenance at Motheo in Botswana and some temporary mobile fleet availability issues. That said, the maintenance was largely timing-related, having been brought forward following a faulty SAG mill grate.

Financially, the quarter was solid. Revenue rose to $344m (from $290m YoY) and underlying EBITDA increased to $167m (from ~$134m), reflecting stronger commodity prices and improved zinc and silver output. Zinc production jumped 20% q/q, while silver was up 9% q/q, offsetting the modest copper decline.

Importantly, SFR reaffirmed full-year guidance, with copper production still expected at 102–114kt, alongside unchanged zinc, silver and capex forecasts. The company also reiterated confidence that MATSA will hit the midpoint of its FY26 production range, supported by higher-value polymetallic ore in the second half.

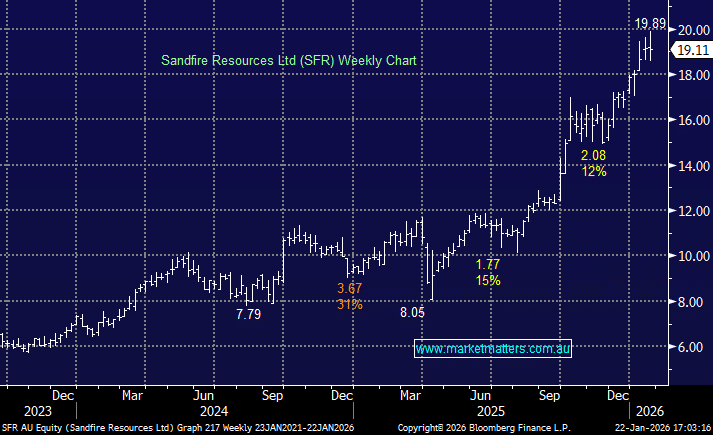

- Shares eased on the day, but they’ve had a very strong run. Nothing in todays update to get us concerned, although the share price is losing some momentum around all time highs. We wouldn’t be surprised to see SFR cool/consolidate now for a while.