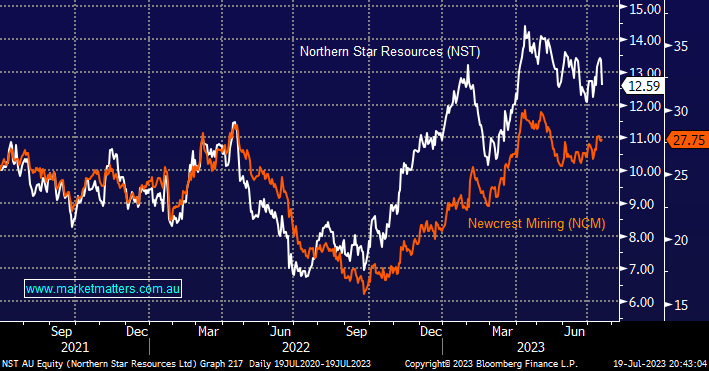

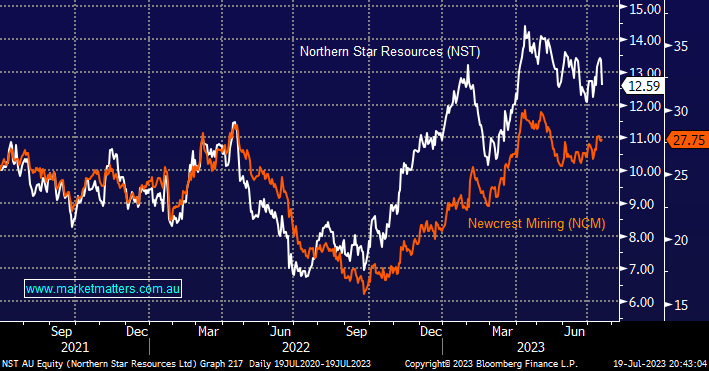

Both gold miners NCM & NST received news yesterday although it had a very different impact on the respective share prices:

- Newcrest (NCM) rallied +0.5% after Newmont (NEM US) received the green light from the Canadian Regulator with respect to its takeover of NCM i.e. one step closer.

- Northern Star Resources (NST) fell -5.8%, the most in 10 months, following a disappointing 4Q update which included all-in sustaining costs of A$1,759/Oz, at the top end of guidance – golds currently trading ~A$2,925/Oz.

Overall a net encouraging move for MM who is looking for an alternative local gold exposure as NCM looks increasingly likely to be swallowed up by NEM i.e. we hold 5% of the MM Flagship Growth Portfolio in NCM. Takeover target NCM is this morning trading 4.6% below its theoretical purchase price by NEM, although this changes with multiple factors at play, our question is rapidly becoming where to put the money as we plan to maintain an overweight stance toward the sector. So far in 2023 NST is +22.6% while NCM has surged +35% courtesy of an all-scrip takeover bid from NEM.

- We are considering NST but in today’s market, disappointing results are tending to see stocks follow through on the downside i.e. not great news for NST and we’re in no hurry on this front.

NB: UBS downgraded NST to sell this morning with & $11.70 pt sighting higher capex as the main reason.